Here’s a basic guide to help you understand the Malaysian Employee Provident Fund (EPF), which is compulsory for citizens and optional for non-citizens. Both employers and employees are required to make monthly contributions.

What is the employee provident fund in Malaysia?

The EPF, or Employees Provident Fund, serves as a retirement planning program for Malaysian employees. It requires both employers and employees to make monthly contributions to the fund.

Employers are required to enroll with the EPF within a week of an employee’s hiring date.

Payments subject to employee provident fund contribution

Besides an employee’s regular salary, there are additional payments that require EPF contributions. These include:

– Allowances

– Bonuses

– Commissions

– Incentives

– Arrear payments

– Compensation for unused annual or sick leave

– Half-day leave wages

– Maternity leave wages

– Study leave wages

Payments exempt from EPF contributions include:

– Service charges

– Overtime pay

– Gratuity

– Retirement benefits

– Termination benefits

– Retrenchment compensation

– Travel allowances

– Any other remuneration or payment exempted by the minister

Employee provident fund contribution rates

Monthly salary | RM 5,000 and below | More than RM 5,000 | ||

Employee’s status | Employer’s contribution rate | Employee’s contribution rate | Employer’s contribution rate | Employee’s contribution rate |

Residents ages below 60 | 13% | 9% | 12% | 9% |

Residents aged 60 and above | 4% | 0% | 4% | 0% |

Permanent residents ages below 60 | 13% | 9% | 12% | 9% |

Permanent residents ages 60 and above | 6.5% | 5.5% | 6.5% | 5.5% |

Non-residents ages below 60 (registered as a member before 1 August 1998) | 13% | 9% | 12% | 9% |

Non-residents aged 60 and above (registered as a member before 1 August 1998) | 6.5% | 5.5% | 6.5% | 5.5% |

Non-residents ages below 60 (registered as a member on or after 1 August 1998) | RM5.00 | 9% | RM5.00 | 9% |

Non-residents aged 60 and above (registered as a member on or after 1 August 1998) | RM5.00 | 5.5% | RM5.00 | 5.5% |

How to calculate the employee provident fund contribution?

Employers are required to determine the EPF contribution amount by referring to the contribution rates outlined in the Third Schedule of the EPF Act 1991, rather than using exact percentage rates, except for wages surpassing RM 20,000.

The Third Schedule comprises five segments, each specifying the monthly contribution rate applicable to different categories of employees:

– Part A: Pertains to employees below the age of 60 who are either Malaysian citizens, permanent residents in Malaysia, or non-Malaysian citizens who were EPF members before August 1, 1998.

– Part B: Applies to employees below the age of 60 who are not Malaysian citizens and became EPF members on or after August 1, 1998.

– Part C: Concerns employees aged 60 and above who are either permanent residents in Malaysia or non-Malaysian citizens who were EPF members before August 1, 1998.

– Part D: Relates to employees aged 60 and above who are not Malaysian citizens and became EPF members on or after August 1, 1998.

– Part E: Applicable to Malaysian citizen employees aged 60 and above.

Example of the employee provident fund contribution calculation

As per the Third Schedule’s monthly contribution rate, for a Malaysian citizen employee below the age of 60 with a monthly salary of RM 15,150, the employer is obligated to contribute 12% (equivalent to RM 1,824), while the employee is required to contribute 9% (equivalent to RM 1,368).

When is the employee provident fund contribution paid?

The EPF contribution should be paid by the 15th of the following month.

If the EPF contribution is not paid within the deadline, a late payment charge will be imposed.

How to submit employee provident fund contributions?

Employers have several options for submitting EPF contributions, such as:

– i-Akaun

– e-Caruman platform

– Online banking

– Authorized bank agents of Bank Simpanan Nasional, Maybank, Public Bank, and RHB Bank

– EPF service centers located across the country

How to register for an employee provident fund account?

There are four primary methods available for registering as an EPF member:

1. Automatic Registration: Membership is automatically initiated once the EPF receives the initial contribution from your employer.

2. In-Person Registration at EPF Counter: You can register at an EPF counter using your MyKad. If the registration is unsuccessful or if you’re not a Malaysian citizen, you’ll need to complete Form KWSP 3. Upon successful registration, you’ll receive your EPF member number.

3. Employer Registration via i-Akaun: Your employer can register you as an EPF member through the i-Akaun (Employer) platform. Your EPF member number will be issued upon successful registration.

4. Registration at EPF Smart Kiosk: Use your MyKad and verify with your thumbprint at an EPF Smart Kiosk. Upon successful registration, you’ll be provided with your EPF member number.

How to activate i-Akaun (Member)?

EPF members have the convenience of tracking their EPF balance, obtaining EPF statements, and initiating withdrawal requests seamlessly through the i-Akaun (Member) platform.

Upon registration, members will receive a temporary user ID and password via SMS, which they can use to activate their i-Akaun. Activation must be completed within 30 days through the i-Akaun website.

To activate the i-Akaun (Member), you need to follow these steps:

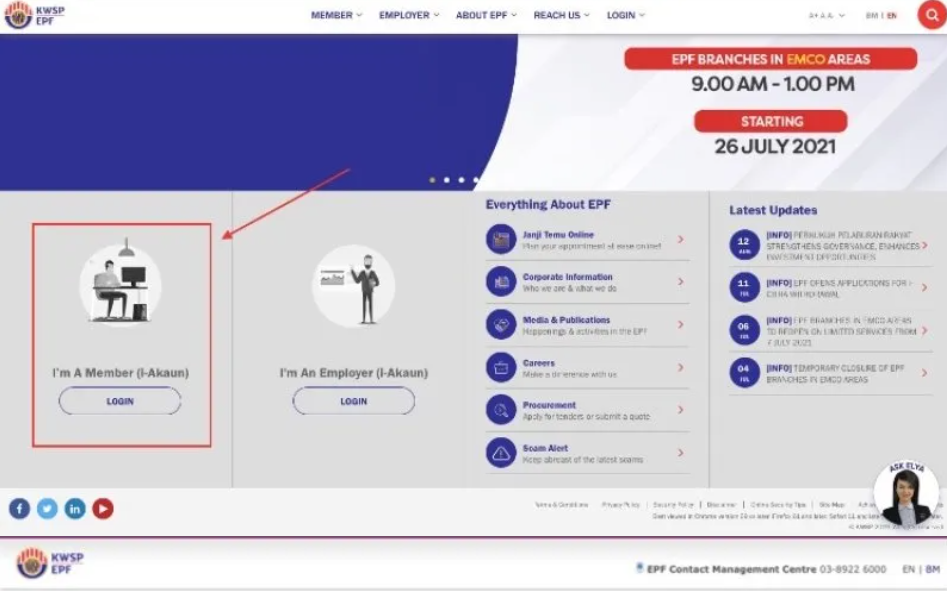

1. Visit the i-Akaun website.

2. Click on the login option under “I’m a member (i-Akaun).”

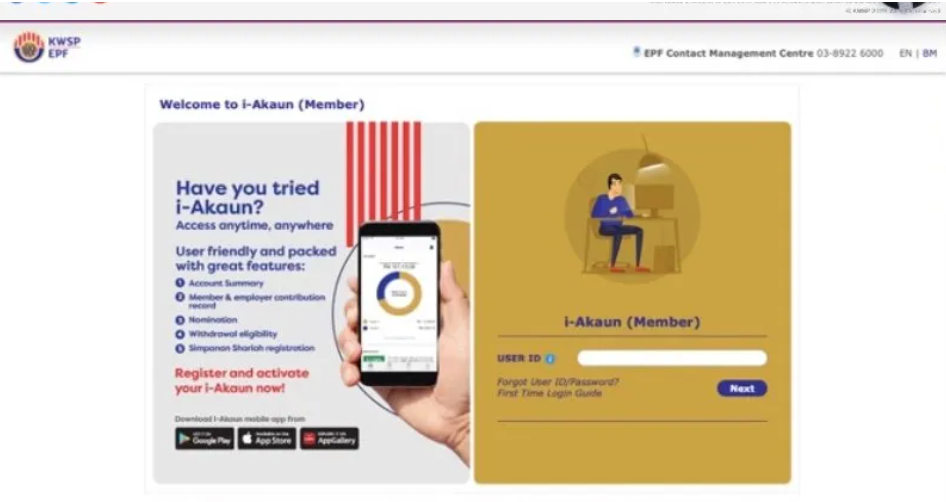

Enter the temporary user ID and click next.

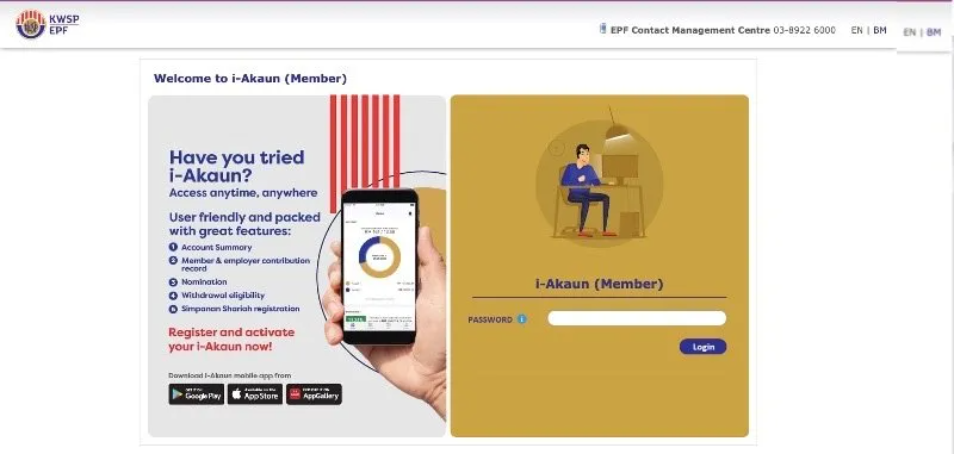

Enter the password and click login.

Once you have gone through the terms and conditions, check the tick box and click next.

This will take you to the First Time Login page. Create a new user ID and a new password and click next.

A successful i-Akaun (Member) new login creation message will be displayed, and you can continue with your new login information.

Penalties for failing to comply with the Employee Provident Fund Act

It is the employer’s responsibility to ensure that they comply with the EPF Act 1991 and contribute to the fund every month. Failure to comply will result in penalties, as shown below.

Offence | Penalty |

An employer fails to register with the EPF within seven days of hiring an employee (section 41(1)). | Imprisonment of not exceeding three years or a fine of not more than RM 10,000 or both |

Failure to pay the EPF contribution on or before the 15th of the following month (section 43(2)). | |

Deducts the employee’s contribution share from the salary and fails to pay the EPF contribution (section 48(3)). | Imprisonment of not exceeding six years or a fine of not more than RM 20,000 or both |

Deducts the employer’s contribution share from the employee’s wage (section 41(1) and 47(2)). | |

Failure to notify the EPF within 30 days from the date he ceased to have any employees (section 41(3)). | Imprisonment not exceeding six months or a fine not exceeding RM 2,000 or both. |

Failure to furnish the statement of wages to his employees (section 42(1)). | |

EPF in Malaysia is a saving and retirement plan for both Malaysian and non-Malaysian citizens which they must contribute to by the 15th of each month at specific rates. If you have any further questions, do not hesitate to contact Acclime. | |