We conduct our audit in accordance with approved standards on auditing in Malaysia. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on our judgment, including the assessment of risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the Company’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by the directors, as well as evaluating the overall presentation of the financial statements.

The financial statements are to be properly drawn up in accordance with Private Entity Reporting Standards and the Companies Act 1965 in Malaysia so as to give a true and fair view of the financial position of the Company.

Why and how to increase paid-up capital

Increase Paid-Up Capital / Issued Share Capital

How much of paid-up capital should I have for my new company?

Any amount from at least RM2 up to the maximum of the authorised capital as stated in the M&A (Memorandum & Articles of Association) of the Company, 100,000 for normal new company.

We recommend paid-up capital of RM1,000 for all new companies upon the registration with SSM.

Why should I increase my company’s paid-up capital?

Normally, there are FOUR (4) REASONS where the company may find itself in the situation it needs to increase its paid-up capital:

1. Requested by Bank

2. A project tender requirement

3. License requirement

4. Corporate image

Reason 1 to increase paid-up capital : Requested by Bank

As part of the terms and conditions in the Letter of Offer from Bank for business loan application submitted by the Company, the company is required to increase its paid-up capital as required by the Bank.

For example, a company is required to increase its paid-up capital from RM1,000 to RM200,000 as part of the requirement for the RM1,000,000 bank loan application from a bank.

Reason 2 to increase paid-up capital : Project Tender

As one of the qualification requirement, the company is to have at least certain amount of paid-up capital before it can submit any project tender document.

For example, a company is required to have at least RM100,000 paid-up capital to be pre-qualified for certain projects from Petronas.

Reason 3 to increase paid-up capital : License application

A company operating in certain industries may be required to have certain licenses before they can commence its business operations. For example, Agensi Pekerjaan Business.

Or a company need to have at least RM500,000 paid-up capital before they can apply working visa for its foreign staff with Immigration Department.

Reason 4 to increase paid-up capital : Corporate Image

A 2-dollar company is not better than a company with paid-up capital of RM100,000!

In Malaysia, any increase in paid-up capital by a company will normally be required to produce some proof or evidence that the company has received the relevant amount of money from respective shareholders, that is why your company secretary will request “bank-in slip” from director before proceed to prepare any relevant documents.

Why increase of capital need bank-in slip from you, as directors of the Company?

It is stated clearly in the Section 48, the Companies Act of which has been extracted as follows:

-No allotment shall be made of any shares of a company unless the sum payable on application for the shares has been received by the Company.

-If a cheque for the sum has been received by the company, the sum shall be deemed not to have been received by the company until the cheque is paid by the bank.

-Every director of a company who knowingly contravenes or permits or authorises the contravention shall be guilty on an offence against this Act.

-Penalty: Imprisonment for three years or one million ringgit or both

For full content of this section, please refer the following link.

http://www.ssm.com.my/acts/fscommand/a0125s0048.htm

Authorized capital & Paid-up capital

Authorised Capital / Paid-Up Capital / Issued Shared Capital

[With effective from 31 January 2017, authorised capital was no longer applicable under the new Companies Act 2016]

What is Authorised Capital?

A company need to confirm its authorised capital before proceed to the registration with SSM (Suruhanjaya Syarikat Malaysia). The amount of authorised capital will be reflected in the Memorandum of Association of every Company.

Why authorised capital?

A company can only issue its paid-up capital up to the authorised capital that registered with SSM.

How it works

If a company has authorised capital of RM100,000, then company can only increase its paid-up capital up to the maximum of RM100,000 at any time.

However, if that company intends to increase its paid-up capital up to RM250,000, the company needs to increase its authorised capital from 100,000 to 500,000 before it can increase its paid-up capital.

Any company is not allowed to increase paid-up capital beyond its authorised capital as stated in the M&A of the company.

Registration fee for Authorised Capital

Every company may increase its authorised capital with SSM by paying the relevant registration fee to SSM.

Annual Return

An annual return is a snapshot of general information about a company’s directors, secretary (where one has been appointed), registered office address, shareholders and share capital.

Important:The Annual Return is not to be confused with Annual Accounts. Annual Accounts are financial accounts, profit & loss etc. Both, however, are legally required to be filed to SSM Malaysia on an annual basis.

Inside Annual Return

An annual return of a company consists of the following general information:

- Registered office address

- Business office address

- Branch office address

- Principal business activities

- Total authorised capital registered

- Total paid-up capital

- Charges registered with SSM (i.e. company assets pledged)

- Company directors

- Appointed company secretary

- Shareholders

When do we need to lodge Annual Return to SSM?

The annual return signed by a director or by the manager or secretary of the company shall be lodged with the Suruhanjaya Syarikat Malaysia (SSM) within one month or in the case of a company keeping pursuant to its articles a branch register in any place outside Malaysia within two months after the annual general meeting.

Statutory Records & Books

STATUTORY BOOKS AND RECORDS

The following documents are required by the Companies Act 1965 to be kept at the registered office of the company:

- Register of directors

- Register of shareholders

- Register of company secretary

- Register of charges

- Register of transfer of shares

- Minutes books

We, acting as your company secretary, will keep all the records up to date and register any changes made by the company

Registered office

Registered office within Malaysia Within 14 days after the date of its incorporationor the day it begins its business, whichever theearlier, every company shall have a registeredoffice within Malaysia to which all communicationsand notices may be addressed.

Registered office is NOT Business office All statutory records, registers, minute books and common seal are required to be kept in the registered office of your company. Your business office is a place where your business operations & activities conducted.

Company Closing

Paying every year just to keep a company? Paid it once for all!

Still paying charges for Secretarial, Accounting, Audit, Tax filing, Annual Returns to SSM which can sum up to RM2,400++ annually? When opening a new company just cost you only RM980! Think about it!

After paying for so many years to just keeping a company, you may want to find a way out to resolve the situation!

Let us help you to save your time and thousands of money.

It just costs you RM1,200 to close down a company, that’s simple as that.

Winding up of an existing Sdn Bhd

There are two ways to close the Sdn Bhd Company:

Option 1. To strike off from the SSM

Option 2. Voluntarily winding up / liquidation of Sdn Bhd

Strike off of company at SSM

There are some basic requirements need to be fulfilled before we can proceed to strike off the company:

1. The company must be inactive for years or at time of application, and

2. The company’s accounts must be clean and have no outstanding debts.

The Striking off application be rejected by the SSM due to the following reasons:

a. The Company has large share base (High level of paid-up capital).

b. The Company has large amount of retained profits.

c. The Company was very active in business not long ago.

d. The Company has recently disposed of a property.

e. The Company has unpaid debts / creditors / liability.

f. The Company are in the legal lawsuit.

As such, SSM will request the Company to go for voluntarily winding up / liquidation process.

Winding Up / Liquidation of Sdn Bhd Company

The voluntarily winding up involves numerous filings & lodgments to SSM and advertising the event over the nationwide newspapers.

The whole winding up process will normally take 1 to 2 years to complete and our price is ranging from RM8,000 to RM10,000. (Depends on the complexibility of the exercise)

Please feel free to contact us for more details & further information and we shall be glad to advise you accordingly.

Company name change

Change company’s name for Malaysian Companies

Reasons for change of company name?

1. Change in management policy or structure

2. Change in ownership

3. Change in business direction or activities

4. Rebranding activities by the Company

5. Change of name for new shelf company

6. Whatsoever reasons, we will do it for you

Make a change, it only takes RM450.

What we need from you

Your preferred new name for your company.

Why wait? Let’s do it for you, it just takes few days to make a change!

Something we want to highlight to you

The OLD Company’s Name is required to be displayed alongside with the NEW Company Name for 12 month-period from the date of change of company’s name.

Sample:

ABC World Sdn. Bhd.

(Formerly Known As ABC Global Sdn. Bhd.)

OR

ABC World Sdn. Bhd.

(F.K.A. ABC Global Sdn. Bhd.)

How it works

1. We shall lodge in the New Name Search Application with SSM

2. Within 2 days, we shall have result from SSM

3. Once approval is obtained from SSM, a general meeting of members will be convened to approve the change of company’s name.

4. We shall lodge the Form 11 to SSM for change of company’s name.

5. Lastly, we shall obtain the Borang 13 (Change of name) from SSM within 3 days from date of submission of Form 11.

Leave it to us, and it takes ONLY RM450.

Our total charges

Our total charges is ONLY RM450.

Basically, our charges include the following:

a. Name search filing fee payable to SSM (1 name)#

b. New common seal and share certificates

c. All necessary documents from change of company’s name

Call us now to act NOW!

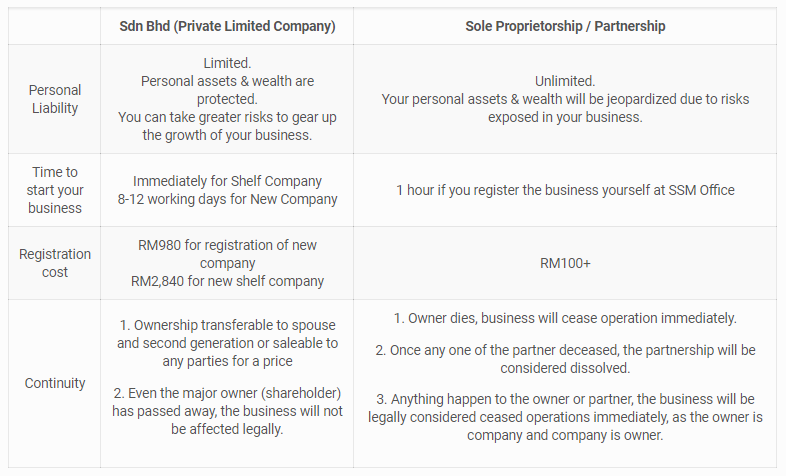

Upgrade from Sole-Proprietor/Partnership to Sdn Bhd Company

Convert your enterprise/partnership to Sdn Bhd Company

There must be one of the following reasons you may want to convert your business from sole-proprietorship (enterprise) or partnership to Sdn Bhd Company (Private Limited Company):

1. You want to enjoy better tax rate and pay less tax!

2. You may need to be a sdn bhd to tender for a project.

3. You want to apply for business loans

4. You want to manage it in systematical and professional way.

5. Better image for your business by having sdn bhd for your business

6. Your business is growing fast and great, you may want to transfer your business to your children.

7. You may want to sale your business for a luxury price.

What do we need from you:

- Copy of Enterprise Registration Form D

- Photocopy of I/C of the directors (at least 2 persons)

- Proposed name for New Sdn Bhd Company

Code of Ethics for Company Secretary

A. INTRODUCTION

With more complex developments in company legislation and the creation of business collaborations to result in larger groups of companies, the role of a company secretary has evolved from just a normal employee to one who is far more important in any company. A company secretary of today is a company officer who is endorsed with heavier responsibilities and a greater power, duties which demand for ethical behaviour from company secretaries at all times.

This Code of Ethics, in general, can be understood to be an adoption of ethics for corporate affairs, which have been formulated to enhance the standard of corporate governance and to instil professionalism and effectiveness in the performance of duties amongst company secretaries.

This Code of Ethics needs to become a code of courtesy that will state all that is true or false and what that is good or bad from a moral point of view.

B. PRINCIPLE

This Code of Ethics is based on the principles in relation to sincerity, integrity, responsibility and corporate social responsibility.

C. OBJECTIVE

This Code of Ethics is formulated to enhance the standard of corporate governance and to instil good corporate behaviour in order to achieve the following aims:

1. To instil the practice of professionalism amongst company secretaries based on the tenets of moral responsibility, competency and effectiveness in administration; and

2. To uphold the spirit of responsibility and social accountability in line with the legislation, regulations and guidelines for administrating a company.

D. CODE OF ETHICS

In the performance of his duties, a company secretary should always observe the following codes:

1. Strive for professional competency and at all times exhibit a high degree of skill and proficiency in the performance of the duties of his office;

2. At all times, exercise the utmost good faith and act both responsibly and honestly with reasonable care and due diligence in the discharge of the duties of his office;

3. At all times, strive to assist the company towards its prescribed objectives based on the tenets of moral responsibility, efficiency, and effectiveness in administration;

4. Have a clear understanding of the aims and purpose of the company as well as the powers and restrictions as provided in the Memorandum and Articles of Association of the company;

5. Be knowledgeable of regulations and procedures for meetings, particularly quorum requirements, voting procedures and proxy provisions and be responsible for the proper administration of meetings;

6. Neither direct, for his own advantage, any business opportunity that the company is pursuing nor use or disclose to any party any confidential information obtained by reason of his office, for his own advantage or that of others;

7. Adopt an objective and positive attitude and provide full co-operation for common benefit when dealing with government authorities or regulatory bodies;

8. Disclose to the board of directors or an appropriate public officer any information within his knowledge that he honestly believes suggests that a fraud is being, or is likely to be, practised by the company or by any of its directors or employees;

9. Limit his secretaryship of companies to a number in which he can best and fully devote his times and effectiveness;

10. Assist and advise the directors to ensure that the company, at all times, maintains an effective system of internal control for the keeping of the necessary registers and accounting records;

11. At all times, be impartial in his dealings with shareholders, directors and, without fear or favour, use his best endeavours to ensure that the directors and the company comply with the relevant legislation, contractual obligations and other relevant requirements;

12 .Be present in person, or ensure that in his absence he is represented, at the company’s registered office on the days and at the hours that the office is accessible to the public;

13. Advise the board of directors so that no policy which is in conflict with the interest of the company’s stakeholders is adopted by the company;

14. Be aware of all reporting and other requirements imposed by the statute under which the company is incorporated;

15. Be present or represented at company meetings and not allow himself or his representative to be excluded or withdrawn from those meetings in a way that would prejudice his professional responsibilities as secretary of the company.

How to remove shareholder from a Sdn Bhd?

Shareholders can leave a company at any time for several reasons: it may be to remove shareholder from a company, recoup investment or as a result of death.

Regardless of the cause, their shares must be transferred through gift or sale to another person.

The new shareholder’s information needs to be recorded in the company’s register of members and subsequently updated in the SSM System.

Remove shareholder from a sdn bhd

Disputes amongst shareholders can result in several challenges. Therefore, endeavour to avoid them as much as you can.

It is very difficult to force members to leave a company. After all, they are under no compulsion to sell their shares, except if the agreement of the shareholders or articles is well-drafted to include a particular departure procedure.

The first thing to do to resolve an issue is negotiation. Most shareholders could offer a fair value for the minority’s shares. If they decline to negotiate, then you could take severe measures by winding up the company.

However, you can only perform this should the minority have below 25% of the issued shares. You will need a 75% majority of the shareholder’s votes to pass a specific motion to wind up the company.

As such, it is impossible to remove shareholder without proper consent from the respective parties

Shares ownership Transfer

Limited company shares can be gifted or sold to other individuals by using a stock transfer form. The company director is in charge of filling in this form to officially transfer ownership from one individual to another. Thereafter, a share certificate, upon request by the shareholder, must be given to the new shareholder.

Shareholder’s death

Should a shareholder die, their share’s ownership may pass under the terms of his or her will to a named recipient. In situations like this, the company director will need to implement a stock transfer form to formally handover ownership to the beneficiary. After all, the transfer of shares to an individual who does not have any relevant business know-how, or subscribe to the company’s visions and objectives can result in huge troubles.

Several companies incorporate provisions in a shareholders’ agreement to handle the demise of a shareholder. It is typical for an agreement to say that, upon a shareholder’s death, his or her shares will be passed to a particular person or be made available for purchase by current company members or the company itself.

Updating member’s register

Every limited company needs to keep a member’s register. This item is utilised to record the names and addresses of every member, details of the shares they hold, the date they were incorporated as a member of the company and the date they ceased to be a member.

Shareholders become members on the date they purchase shares. They stop from being members on the date their shares are transferred to another person.

The resignation of director

A resignation of director can be effected by the existing director tendering his resignation to the board of directors.

You can have an existing director resigned from your company as long as they are not the only director that is currently listed on the board of directors.

If you are seeking to replace a single director with another one, you would need to add the new director first before having the old one resigned to ensure that there is always at least one serving director listed for the company at all times.

The sole company director must also be a person, not a corporate entity such as another company or a firm.

How to resign as director from sdn bhd?

A person may resign as company director in sdn bhd by tendering his resignation in writing to the board.

Upon receiving the intention from the director to resign as company director, the board of director must notify the company secretary.

The company secretary will prepare the resolution for the board to approve the resignation of the director and then submit the relevant document to SSM.

The information indicated in the document submitted to SSM includes:

- Date of ceased as director

- Full name

- Identity card number

Board of directors may reject the resignation of director

In some circumstances, the board of directors may refuse to accept the resignation of director and refuse to lodge the resignation document to SSM.

The refusal may due to the following considerations:

- The resigning director is a contract employee

- The resigning director is a party to the shareholders’ agreement

- The resigning director is involving a possible serious breach of trust case

It is important to have the mutual understanding from all parties to resolve the matter in the win-win situations.

Why start your own business?

Starting a business is to make a change for better future.

“Change is the law of life and those who look only to the past or present are certain to miss the future.”

– John F. Kennedy, 35th President of the USA

An entrepreneur is anyone who chooses to go it alone and make the most of a business opportunity for themselves no matter how big or small.

Reasons for starting

People choose to become entrepreneurs for a variety of reasons.

For some it will be an opportunity to escape their mundane nine-to-five existence and to commit their working lives to something which is a lot closer to their heart.

For the ‘lifestyle’ entrepreneurs the important part of the deal is not how big their business ends up but the effect in has on their lives.

For more and more people this is becoming a legitimate career choice. Gone are the days when you had to have years of business experience under your belt before you might even consider taking the plunge with a startup of your own: nowadays everybody’s doing it.

And if you’re reading this, you’ve already taken your first steps in joining them

What business you can start

David Creswell, 27, of comics website ComicDomain.co.uk falls into this category: “I don’t care if I’m a comic geek, it’s my hobby and I’ve turned that into a small business, I’m proud of the service we provide and our customers are also happy.”

For others the motivation for starting up will come from spotting a gap in a market they know well. ‘Ski Bums’ Tim Slade and Jules Leaver spotted an opportunity for ‘been there done that’ T-shirts to sell to skiing holiday makers. Their high street chain Fat Face now turns over £25m.

And for Dee Edwards, 29, the same sort of insight helped her to launch internet company Habbo Ltd. “I really believed internet business could be made successful by using technology to run a business effectively and leveraging the different way people were changing their communication,” she says.

Whether it be t-shirts or technology the world is littered with those who’ve been able to see a business opportunity others simply can’t. In fact a lack of business experience could well give you the kind of perspective those with a blue-chip CV would struggle to attain.

What qualities you need

Passion

If you are going to choose to become an entrepreneur, one of the most important factor is passion.

No matter how much your potential your business might have for making money, unless you believe in it, how can you expect anyone else to? A bit of self-belief can go an awful long way.

Commitment

Hand in hand with passion comes commitment to the cause.

From day one you’ll need to work incredibly hard, often forgoing friends and family to get your venture off the ground.

You need to ask yourself whether you’re prepared to make that kind of sacrifice and whether you can keep yourself motivated to put in those long, long hours.

If you’re the sort of person who’s new year resolution lasts until January 2nd you might want to think again whether you’ve got what it takes, particularly when things might not be going your way.

Be alone

And, as you’ve probably realised, you’ll be going through all of this on your own.

While escaping the office might seem like paradise now you could soon be longing for a bit of mindless gossip and backchat.

You’ll need to dig deep to find the kind of emotional resilience to keep you from losing the plot when there’s no-one around to lend a helping hand.

So while you don’t need qualifications on paper, not just anyone can become an entrepreneur.

But if you think you’ve got what it takes then it could be one of the best decisions you ever make.

Appointment of director by board of directors

Reasons on the appointment of director by board of directors

The board of directors can appoint a person to fill a casual vacancy.

Casual vacancy of the board of directors occurs due to:

- death of a director

- bankruptcy of a director.

The Malaysian Companies Act 2016 also gives the board power to appoint additional directors up to the number fixed by the Constitutions.

Appointment of the alternate director

Sometimes the articles allow a director to appoint an alternate or substitute director to act for him at any meeting which he is unable to attend, or to act for him during his inability to act as a director.

The person appointed as alternate or substitute director is placed in the same position as any other director.

However, in counting the statutory minimum number of directors of a company, the alternate or substitute directors are not counted.

A director of a public company may assign his office to another person if this is permitted by its articles or by an agreement between the company and any person empowering a director to assign his office. Such assignment of office requires a special resolution of the

company.

Why Setup Company in Malaysia

Malaysia itself is well located within Asia Pacific and Asean! Malaysia with recent ranking being the top 6thcountry in the world as the most easiest and friendliness in doing business by World Bank! Malaysia achieves a commendable surge from 23rd position to 6th position among 189 economies in the latest World Bank Doing Business 2014. This proof Malaysia truly on track on its economy transformation and bale to poise a place of investment welcoming foreigners!

Malaysia is ranked number one for Getting Credit, number four for Protecting Investors, number five in Trading Across Borders and is the 6th most competitive among 189 economies in the World Bank Doing Business 2014

Malaysia is a place of growth! A place of stability, affordable living with abundance of business investment opportunities in Malaysia! Malaysia welcomes foreigners! Begin your start-up in Malaysia, a perfect place to spring board of your business to the region!

The new Limited Liability Partnerships Act 2012 which came into force in December 2012 introduces limited liability partnerships (LLP) as a new alternative business vehicle which offers flexibility in terms of its formation, maintenance and termination and reduction of company registration fees in Starting a Business. Entrepreneurs now have more options to choose the most preferred form of business vehicle and the introduction of LLP would benefit small businesses (start-ups), professional groups, joint ventures and venture capital funds.

Industrial hub

A foreign owned company can invest in every business sector.

Because of the abundance of cheap raw materials and skilled labour, Malaysia’s reputation as a manufacturing hub is growing considerably. The country is rich in several natural resources such as palm oil, rubber, timber, oil, and tin;

Due to Malaysia’s vast amount of natural attractions, Malaysia is labelled as “a destination full of unrealized potential” by the World Travel and Tourism Council (WTTC). Therefore there is lots of growth potential in the Malaysian tourism industry which foreign investors can tap into with Malaysia business registration;

Malaysia is an ideal location for a regional headquarters. Located in the centre of South East Asia, Malaysia is in close proximity to many leading Asian markets such as Singapore, Vietnam, Thailand, China, and India; Malaysia is a natural choice for shared services in view of its low costs, particularly for infrastructure, conducive business environment, and high levels of global integration.

The labour market conditions in Malaysia are favourable. Labour costs in Malaysia are relatively low while productivity levels remain high in comparison with industrialised countries. Basic literacy among the labour workforce is high, and the workforce is youthful and trainable and the environment is generally strike-free.

With four major ports, and an ideal location on the straits of Malacca, Malaysia is an excellent location for trade by sea;

Malaysia boasts five free zones offering foreign companies no custom duties, and flexible trading laws. The five free zones are Pasir Gudang, Port Klang, Port of Tanjung Pelepas, Kulim Hi-Tech Park, and Bayan Lepas;

Malaysia is a member of the Association of South East Asian Nations (ASEAN). Therefore companies registered in Malaysia can benefit from the free trade agreements that exist between the member states;

In order to attract foreign investors in Malaysia investment, some laws in regards to foreign ownership are being relaxed. The foreign ownership limit of stock brokerages is to be increased to 70% from 49%. There can now be 100% foreign control in wholesale fund management companies in Malaysia. The limit for unit trust companies has also been increased to 70%;

To attract foreign investors and encourage Malaysia business, the Malaysia government developed industrial parks, including free industrial zones, technology parks, and Multimedia Super Corridor (MSC). There are investment incentives such as Pioneers status, BioNexus status and Multimedia Super Corridor (MSC) status where companies can enjoy tax free for a number of years;

Malaysia’s continuous economic growth is reflected by the average GDP growth for the past 10 years of 1.17%. Malaysia has registered GDP growth of 6.3% which is the highest among ASEAN countries in the first half of 2014.The estimated GDP growth for 2014 & 2015 is between 5.5% and 6%. This continuous growth means more opportunities for entrepreneurs;

A cheaper alternative to Singapore

Malaysia is a great alternative to Singapore for a regional headquarters due to business costs.

In 2012, Malaysia’s monthly office rental space was US$17 per sqm. This is significantly lower than Singapore’s average monthly office rental space of US$ 68 per sqm

The average worker in Malaysia is more affordable than in Singapore. In 2012, the average wage in Singapore was US$3,245 whilst the average wage in Malaysia was only US$2,310;

To rival the successful Singapore tourism sector, Malaysia is aggressively building hotels, amusement and theme parks, shopping malls, luxurious residential complexes, art galleries and museums. By 2013, Malaysia is expecting to attract 29 million tourists;

Malaysia wants to repeat the success of Singapore by growing its industrial and services sectors. For example, Malaysia has already developed ports such as Port Klang to serve major shipping routes;

To compete with Singapore’s manufacturing sector, Malaysia provides investment incentives such as a pioneer status, and an investment tax allowance to foreign manufacturing companies.

Language

English is Malaysia’s second language, and is spoken by 70% of the population. Therefore, foreign investors interested in Malaysia will easily be able to communicate with local employees, customers and suppliers;

Business documents are mostly available in English, therefore translation costs and time can be saved during company registration in Malaysia or when conducting business.

Islamic community

Malaysia is a great location for members of the Islamic Community who wish to invest in South East Asia. Here are a few reasons why members of the Islamic community should consider Malaysia:

Halal Parks – These parks are designed to ease business registration procedures in Malaysia and provide incentives for all Halal-related manufacturing sectors;

Liberal views on Islam – Malaysia can be seen as the gateway between the “Islamic world” and the “Western world” due to their modern Islamic practices. As a result of this, Malaysia’s economy is suited for both Islamic and Western corporations;

Islamic Banking – Malaysia has one of the biggest sharia compliant assets. There is no restriction on repatriation between international Sharia bank accounts.

Population

The demographics of Malaysia are represented by the multiple ethnic groups that exist in this country. In 2010, Malaysia’s population is 28.6 million which makes it the 41st most populated country in the world. Of these, 5.72 million Malaysians live in East Malaysia and 22.5 million live in Peninsular Malaysia. The Malaysian population continues to grow at a rate of 2.4% per annum. In 2010, the Malays were 60.3%, Chinese 22.9%, and the Indians 7.1% of the total population. Malaysia’s population is projected to increase by 10 million (35.0%) to 38.6 million in 2040.

Political Structure

The ethnically and religiously diverse constitutional monarchy of Malaysia has been ruled by the United Malays National Organization since independence in 1957.

Currency

Malaysian Ringgit (“MYR”)

Type of Law

Common Law

Appointing the Right Person as your Nominee Director in Malaysia

We will provide you with local Nominee Directors who are Malaysia citizen and closely associated with the management team in Bayabumi Accountancy, with guaranteed good services. Bayabumi Accountancy has been providing Nominee Directors services in Malaysia. Based on our extensive experiences and good feedback with 100% satisfaction rating received so far, we are confident that we will be able to provide you with guaranteed quality of Nominee Director Services that would satisfy your requirement. The Nominee Directors are supported by highly competent professionals and have the required skill set needed to discharge their duties as local directors and to assist companies in the fulfilling of the requirements and guidelines as set out in the Companies Act and by the local Authorities. Bayabumi Accountancy can help companies to maintain their good standing status and ensure their full regulatory compliance at all time. As the responsibilities of the Nominee Directors are very onerous, to safeguard the interests of the nominee director, we require a security deposit to be kept with us for as long as our Nominee Director Services is being engaged.

Our Nominee Director will sign an agreement with you to provide you with the assurance that they will not be involved in your business operation, as well as not to be your bank signatories, so that you can have full control over your bank account(s) and company.

We understand that we have competitors who are not collecting security deposit but you should always be aware that they usually are able to do so by outsourcing their Nominee Director services.

Some service providers in Malaysia are providing nominee director services without performing any due diligence review. These service providers are taking the risk of ending up with high risk clients especially those who are involved in money laundering or terrorism financing activities.

If a nominee director is involved in a legal suit, all the companies with the same nominee director will be affected as well. That nominee director might implicate your company resulting in investigation being carried out on your company. This is a very serious implication to you and will cause ample inconvenience to you including requiring your regular presence in Malaysia to assist with any investigation.

Only service providers who meant business and are concern with the reputation and well-being of all their clients will perform due diligence review and ask for valid and sufficient supporting documents to ensure conformity. This is a good practise which is beneficial to you as they will perform thorough screening of their potential clients ensuring that all clients are good and will not implicate each other causing unnecessary losses or inconvenience.

You should also be sceptical with service providers that do not perform or perform minimum due diligence review and are able to set up a company for you with nominee director services using basic information such as passport and address proof only. Such errant service providers may be black-listed by financial institutions as high risk client category resulting in difficulty or pro-longed process in opening a bank account.

While some people have the misconception that companies with foreign setup will not be able to have a bank account successfully opened by the financial institutions, it is in fact due to the due diligence review issue which resulted in them being listed as high risk clients by the financial institutions. That is the reason why most banks prefer a foreigner with valid work pass before they consider approving a bank account for the foreigner as they could perform their due diligence review based on records available in the government’s database.

With the above analysis, please rest assured that with Bayabumi Accountancy , you will not encounter any of these problem. Our world class due diligence review system which has passed the assessment by the Singapore Authority is of guaranteed quality of services. For customer like you and those who has reputable branding overseas the quality of your nominee director , is important and our assurance is to provide you with the stability required including the commitment of fulfilling all the rules and regulations.

With such good system, financial institutions place high confident in us and we have very close banking relationship with them. This can assure you a smooth and easier process for any bank account opening application, even with a 100% foreign ownership company, if you are starting a genuine business start-up in Malaysia. Based on our records, we have not encountered any rejection of bank account opening application because of sole foreign ownership issue.

Choosing between having a local Malaysia nominee or not largely depends on the requirement of the nature of your business. If one is not careful on the appointment, the following four complications may arise:

- All directors are required to sign company documents for the smallest changes, nominees do not turn up to sign.

- Nominees credit score over time is not good, this will affect the health of the company

- Dispute to claims of the Company’s authority and shares.

In Bayabumi Accountancy , we provide our own Nominee Directors to guarantee our customers safety. You can terminate our Nominee Director Service anytime by providing us with the details regarding an alternate local resident director. We will do the necessary paperwork, file the change with authorities and promptly refund the security deposit back to you.

Contact Us

10 Key Changes in Companies Act 2016 that You Should Know

Companies Act 2016 have finally come into force on 31st January 2017. It is said to create an environment that is more cost-effective for businesses .

Main changes that YOU SHOULD KNOW :-

- One Person Company – Private companies can now be incorporated with one person being the only director and the only shareholder. Besides, the appointment of the first company secretary can be made within 30 days from the date of incorporation of the company.

- Removed Authorised Share Capital – Private companies would no longer have Authorised Share Capital. There will only be Paid Up Capital.

- No Par Values Shares – This means that issuance of shares no longer carries a par value.

- Memorandum & Articles of Association (M&A) – M&A is no longer needed for incorporating a new company. For existing company with M&A, the M&A will now be deemed to be the Constitution. It is recommended that companies review their M&A and make appropriate amendments, construct a Constitution; or choose not to have their own M&A / Constitution.

- Common Seal Not a MUST HAVE – Companies are no longer required to have a common seal.

- Annual General Meeting – Private companies are no longer required to hold AGM as it can be simplified by passing written resolutions, unless constitution stated otherwise.

- Filing of Annual Return – The annual return shall be lodged not later than 30 days from the anniversary of the incorporation date. Previously, the annual return would be filed after the AGM.

- Dividends – Before declaring dividends, directors must be aware of the new solvency requirement.

- Form 9 Has Been Removed – Companies will only receive Notice of Incorporation upon successful incorporation. Certificate of Incorporation will be issued upon application by the company and upon payment of a prescribed fee.

- Publication of Name – A Company shall disclose its registered name and registered number on websites and all other forms of its business correspondence and documentation.

One-Stop Bayabumi Accountancy Services

As a business owner, you dream of undivided focus on growing your business and increasing your profits. Last thing you want is your management resources being tied up by unproductive reporting, compliance and administrative work. However, you felt that you had no choice, as hefty penalties can be disastrous to your business should your team overlooked any material requirements.

At Bayabumi, we are professional accountants who understand business. That is why our solid, comprehensive offerings are put together to satisfy needs of most business owners. With a dedicated service personnel and multiple expert teams to help you in areas including GST, income tax, bookkeeping and company secretary, you can allocate more time to focus on your business activities. In terms of business consultancy, we are also able to leverage our one-stop proposition to take a helicopter view and share useful insights of your business situations.

A GUIDE TO EPF WITHDRAWALS IN MALAYSIA

The Employees Provident Fund (EPF) is the federal statutory body under the Ministry of Finance. The fund manages the compulsory savings plan and retirement planning for workers who are employed in the private sector in Malaysia. This is a mandatory requirement for Malaysiancitizens, and voluntary for non-Malaysian citizens.

Both employees and employers will make a contribution to their EPF accounts. Private sector employees who are members of the EPF will be able to withdraw all or part of their savings once they have reached the age of 55-years. They can opt to withdraw any amount at any time.

EPF withdrawals are available for eligible members who are Malaysian citizens or non-Malaysian citizens residing in Malaysia who have an EPF account, but they must be between 55 and 59-years old and hold their savings in Account 55. There is no minimum withdrawal amount required.

All applications for withdrawal must be made one month prior to reaching the age of 55, as members will only be paid once they have reached that age. Members may opt for full or partial withdrawal until they have reached the age of 100-years.

How EPF Payments Are Made:

EPF members will have their payments credited directly into their bank accounts, subject to the following conditions:

- Members have an active account that is with a panel bank appointed by the EPF

- The member’s identification number MUST match the bank’s record

- Payments will be made in Ringgit Malaysia (RM)

If a payment can’t be credited into a member’s account, a banker’s cheque will be issued instead.