Malaysia is a prime business destination envied by thousands of investors keen on starting ventures abroad. In Asia the most stable political and economic systems. Its tax regime is also appealing to a myriad of investors who would love to tap into the region’s potential. The factors only make it ripe for business. Malaysia has incredible opportunities to start a variety of businesses in various places across the country. For anyone looking to success for the businesses to start in Kuala Lumpur or any of the resort cities.

In Malaysia the entire pie is no longer available if you are thinking of starting a new business. To come up with a proposition that still has good potential.If you choose to join the mainstream industries. You will still have a duty to give your very best. You will be suffocated by the stiff competition that already exists in the business arena. Here is a brief look at some of the highly in-demand business you may consider if you have any plans of starting a business in Malaysia.

Cleaning Business

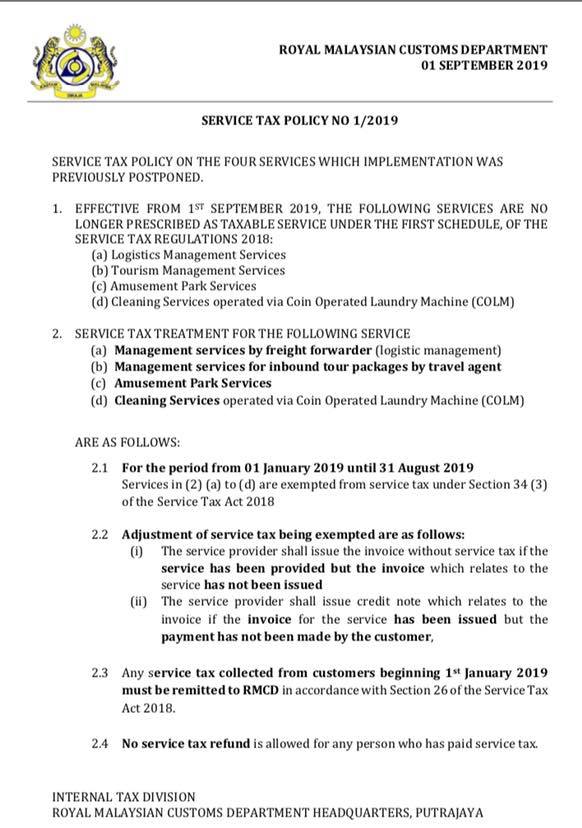

Cleaning is a necessity for everyone. The modern lifestyle, very few people get the time to clean their clothes regularly. In Malaysia you should be aware that there are several cities with prime targets for this kind of business. Both the young and the old are always on the move’s such, they will appreciate generously anyone who can come in and help them with taking care of their clothes. In Malaysia this is what makes cleaning services one of the most sought after services in the major cities. The capital needed to start a cleaning business is not high. The necessary skills to make clothes come out of the washers clean are also very minimal. The company location, you may not need lots of advertisement. If you can do a good job, word of mouth will be sufficient to make clients keep knocking on your doors.

Consultant Services in Malaysia

Like Malaysia country business-centric will always be a haven for consultants. This may be a broader term and could refer to many services, The qualification to advice other professionals, businesses and individuals on how to get the results they want, then you will always be in business. Malaysia is full of companies, services, and individuals who need help in the manner of consulting. It is up to you to know how best to position yourself and tap into this evergreen niche. There is a high demand for consultants in several areas.

Such as-:

- Online retailing – this is a fast-growing sector in Malaysia, and nearly every business is rushing to have an online presence. They don’t know how to do it. If you have skills in this area, then you should consider Malaysia as your base for building a business.

- Energy efficiency – the craze about energy in the world currently is about clean energy and energy efficiency. There are not so many energy efficiency experts in the country. And this is another area you could exploit to establish a very profitable business.

- Social media consultant – businesses, companies, and corporations can no longer ignore the importance of social media as a tool for growth within the business set up. The problem is that this is a relatively new concept and marketing approach. Not so many people know about it,but they are in desperate need for it. If you are an expert in this field, then Malaysia is a fertile ground for you to start a business.

- Other industries where consulting services are likely to thrive in Malaysia include-: education consulting, health insurance consulting and digital marketing consulting, among others.

Online E-commerce Business

In Malaysia online shopping is quickly taking over the retail industry, especially in big cities. In Malaysia now would be an excellent time to consider it as among the top businesses to start. In the country will be at 74% by 2020 it is estimated that e-commerce penetration. This suggests that nearly three-quarters of the 5.5 million residents will be buying their stuff from the internet. In Malay cities is that it demands very low capital the beauty of starting a business. You can be up and running in no time with expert digital marketing services. All you have to ensure is that you offer quality products and services, and always on time when it comes to delivery.

Digital Marketing Services

Every company realizes the need to market their products online with the penetration of social media. In digital marketing need to online presence businesses. Public and government institutions are also interested in tapping into these new modalities of marketing. The most of their target audiences spend a lot of time in online. The internet exists; there will always be demand for digital marketing services. In Malaysia this is what makes it such a great idea worth considering when you want to start a business.

Education & Training Agency

In Malaysia is another fast-growing sector worth considering is Education & Training services. In Malaysia is a shortage of institutions to provide quality education a growing need for niche-centric training. Mostly people around the world are spending their time. The main impact on their careers is they can spend that time and energy learning specific things. In Malaysia it is very high demand those kinds of training that are on. Acquire such specialized training without traveling away from home to get the training.

Franchise Business

The Malaysia has over the past few years emerged .The country has a strong presence of international franchises. In Malaysia still offering more opportunities for investors keen on setting shop. The higher purchasing power of the local population this wave can be attributed to a large number of expats in the country. The success is nearly guaranteed if you can get into fashion, food and cleaning industries.

Professional Services

In Malaysia high demand in just like consulting services, professional services of all sorts. The Companies, businesses, corporations, and individuals require the skills necessary to help them grow their businesses. In Malaysia Irrespective of the skills you may have, someone is always looking for you. To real business problems you have to do is package yourself well and show that you can offer real solutions. The hot niches for these services include legal services, financial services, travel advisory, healthcare services, education, and training, amongst others.

Recruitment Agency

In Malaysia is not just a hot destination for companies and corporations keen on taking advantage of the low tax rates.For the workers interested in working in such a flourishing environment. All the companies relocating to Malay cities will always need manpower for their operations. In Malaysia If you are considering starting a business is what makes the idea of running a recruitment agency such an appealing one.The foreign workers are keen on learning how to get jobs in Malaysia and how they can settle. As a recruitment agency, you are one resource that they can’t do without.

Retail Business

The Malaysia is a strong economic power in Southeast Asia. It has a strong presence of retail giants, as well as those that are just getting starting. Its position in the region makes it a hub for business to and from Southeast Asia. Is simply incredible the retail opportunity in the country. Whether you want to be biased toward importation, or you want to sell stuff from the region to the rest of the world, if you start a retail business with unique and fast-moving goods, then the sky will be the limit for your success. The capital requirement to start a decent retail store may be high, but the returns will be worth the high cost of starting.

Restaurant F & B Business

Another sector worth considering when you want businesses to start in Malaysia is the restaurant and food & beverage industry. It is an evergreen industry where you can be assured of getting excellent profits when you get it right. Kuala Lumpur cities like are a multi-cultural society with a great diversity of culinary influences. You may decide to start a completely new concept, or you can adopt any of the already working restaurant models and improve on it. If you specialize in preparing foods from a particular region, you can start a restaurant and build a brand around it. The composition of the Malay population is very diverse (especially around cities), and irrespective of the type of food joint you choose to start, people will always be willing to try out your dishes.

In Malaysia there are a few of the currently lucrative business you should think about seriously if you are looking for businesses to start. In Malaysia they have demonstrated to have the potential necessary for building a business that will thrive under the current environment. We strongly advise that you take your time to research and know all the legal requirements needed to start the business.