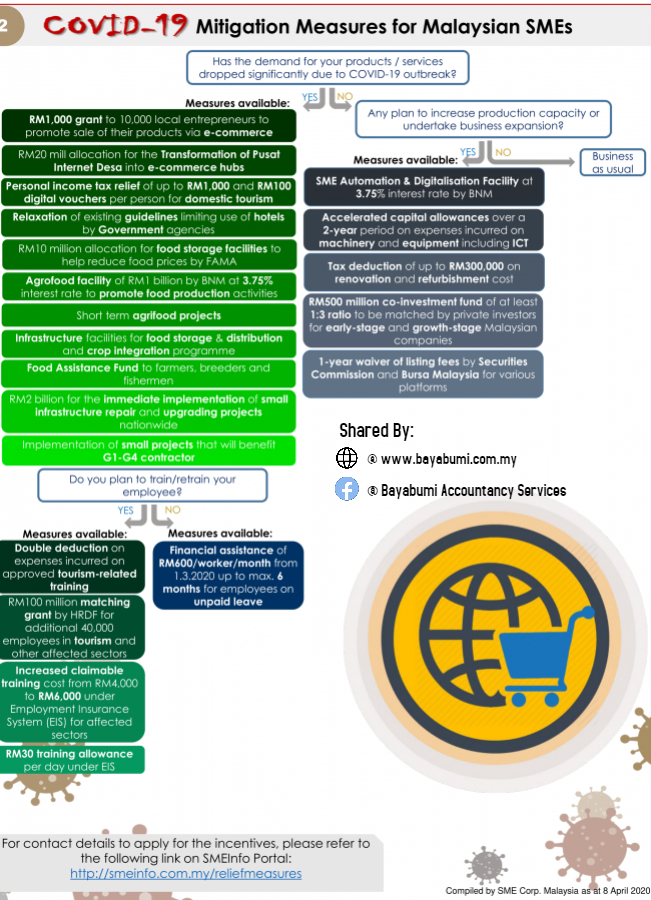

These are the Covid-19 Mitigation measures provided by the government for Malaysian SMEs. For better view of information, you may download the document in the download link below.

Skim Peka PKS peruntuk RM30 juta bantu IKS dan PKS

GEORGE TOWN – Kerajaan Negeri hari ini mengumumkan peruntukan RM30 juta melalui Skim Pinjaman Kelangsungan Perniagaan Pulau Pinang atau secara ringkasnya, Skim Peka PKS khas kepada usahawan-usahawan Industri Kecil dan Sederhana (IKS) dan Perusahaan Kecil dan Sederhana (PKS) di negeri ini.

Menurut Ketua Menteri, Y.A.B Tuan Chow Kon Yeow, objektif skim tersebut adalah untuk membantu usahawan mikro serta usahawan PKS di Pulau Pinang bagi membolehkan mereka meneruskan perusahaan masing-masing dengan penyediaan pusingan modal yang terjejas dalam tempoh kesukaran ketika penularan wabak COVID-19 sehingga menyebabkan pelaksanaan Perintah Kawalan Pergerakan (PKP).

“Realitinya, Kerajaan Negeri melihat sektor PKS dan IKS ini sebagai rakan kongsi yang sentiasa bersama-sama Kerajaan Negeri dalam membangunkan Negeri Pulau Pinang.

“Justeru, diharap menerusi Skim Peka PKS yang permohonannya mula dibuka bermula 8 April 2020 ini dapat membangunkan semula ekonomi Negeri dan negara agar kehidupan rakyat boleh kembali seperti biasa,” ujarnya pada siaran langsung menerusi laman Facebook beliau di sini tadi.

Kon Yeow dalam pada itu memberitahu bahawa semua permohonan perlu dibuat dalam talian melalui laman web www.pdc.gov.my dan tarikh tutup adalah pada 21 April 2020.

Secara ringkas, intipati Skim Peka PKS yang disediakan adalah melibatkan dua kategori iaitu untuk IKS dan PKS, iaitu:-

*Bagi IKS yang terlibat dalam sektor pembuatan, permohonan pinjaman adalah sehingga RM50,000.

*Bagi PKS yang terdiri daripada syarikat yang terlibat dalam sektor lain pula, permohonan adalah sehingga RM20 ribu.

*Skim ini ialah pinjaman tanpa faedah yang perlu dibayar kembali mengikut kaedah berikut:

- Pada enam (6) bulan pertama, peminjam tidak perlu membuat sebarang pembayaran balik.

- Pada bulan ke-7, peminjam perlu mula membuat pembayaran balik setiap bulan sehingga bulan ke-30.

- Sebagai insentif, rebat akan diberikan kepada peminjam yang berjaya melangsaikan pinjaman pada bulan ke-18 ataupun sebelumnya.

- Sekiranya pinjaman gagal diselesaikan dalam tempoh 30 bulan, penalti bayaran lewat sebanyak 8 peratus akan dikenakan.

“Memandangkan peruntukan Skim Peka PKS adalah berjumlah keseluruhan RM30 juta, maka pinjaman hanya akan diberikan kepada pemohon yang memenuhi syarat-syarat dan secara ‘first come, first serve basis’.

“Pada dasarnya, apa yang ditawarkan menerusi Skim Peka PKS merupakan simbolik komitmen Kerajaan Negeri terhadap golongan usahawan IKS dan PKS di negeri ini.

“Umumnya, golongan usahawan adalah juga diseru untuk membuat permohonan terhadap Bantuan Prihatin PKS yang diumumkan oleh Kerajaan Pusat sebelum ini,” ulasya.

Layari www.pdc.gov.my dan hubungi Bilik Gerakan Skim Peka PKS di talian 04-6340234/335/323/870/137 yang akan beroperasi mulai 8 April 2020 jam 9 pagi hingga 5 petang (tutup pada Sabtu dan Ahad) bagi maklumat lanjut.

SOURCES: https://www.buletinmutiara.com/

WEBPAGE YOU MAY REFER:

SKIM PEKA PKS: https://www.pdc.gov.my/index.php/en/skim-peka-pks

INFO ABOUT WAGE SUBSIDY PROGRAMME (WSP)

Q1. What are the criteria to receive Wage Subsidy?

a) Employers and Employees have to be registered and contributed Employment Insurance System (EIS);

b) Employers have to make declaration that the company suffered declining revenue more than 50%,by comparing with the total sales in January 2020 with the following months;

c) Employees with the wages of RM4,000-00 and below, subject to 100 pax;

d) Employers have to ensure they will not (i) dismiss the Employees, (ii) instruct the Employees to take unpaid leave; and (iii) deduct salary for 6 months (3 months while receiving Wage Subsidy + 3 months subsequently).

Q2. Who are NOT qualified to apply for Wage Subsidy?

a) Employers and Employees not registered or contributed to EIS;

b) Employees have received subsidy under Employment Retention Program (ERP);

c) Employees’ wages exceed RM4,000-00;

d) Employees under public sector, statutory bodies, and local authorities;

e) Those who work on their own (without Employers) including, freelancers; and

f) Foreign workers and expatriates.

Q3. How to apply Wage Subsidy?

Application to be submitted online from 1/4/2020 at prihatin.perkeso.gov.my, together with the list of Employees, Employers’ bank account information, registration of bank panel of Employers/ MyCoID, SSM/ROS/ROB of the Employers/ Declaration PSU50 and supporting documents as to the declining sales more than 50%

Q4. Are the Employers entitled to apply for ERP and ESP for one same Employee in the same month?

No.

Q5. What is the definition of “Wages”?

Under Employment Insurances System Act 2017 (as per the photo below), Wages means all remunerations payable in money by an employer to an employee including any payment in respect of leave, holidays, overtime and extra work on holidays but does NOT include—

(a) any contributions payable by the employer to any pension fund, social security fund or provident fund;

(b) any traveling allowance or the value of any traveling concession;

(c) any sum paid to the employee to pay for special expenses incurred as a result of his employment;

(d) any gratuity payable on discharge or retirement;

(e) any annual bonus;

(f) any benefit under any other written law administered by the Organization; and

(g) any other remuneration as prescribed.

Q6. If the Employers and Employees have reached a consensus for taking annual leave/ unpaid leave or pay cut, are the Employers entitled to Wage Subsidy?

No.

INFO : PERMOHONAN SKIM PEMBIAYAAN PEMULIHAN PERNIAGAAN SEKTOR MIKRO SEMASA PKP

Skim ini adalah inisiatif Kementerian Pembangunan Usahawan dan Koperasi melalui Tekun Nasional.

SYARAT KELAYAKAN;

- Warganegara Malaysia.

- Terbuka kepada semua sektor perniagaan

- Perniagaan sepenuh atau separuh masa.

- Berdaftar dengan SSM atau lesen penjaja (permit PBT).

- Tidak disenarai hitam oleh institusi kewangan.

- Bebas daripada tindakan kebankrapan.

KAEDAH PERMOHONAN

- Muat turun borang permohonan di – https://bit.ly/39Sr2Ba

- Mengisi borang ‘on-line’ – https://bit.ly/2RfkBSv (perlu ada akaun Google untuk log-in).

- E-Mel ke cbrm@tekun.gov.my

- Pemohon akan dihubungi oleh TEKUN untuk pengesahan maklumat.

DOKUMEN YANG DIPERLUKAN

- Salinan sijil pendaftaran syarikat (SSM) atau lesen perniagaan.

- Salinan kad pengenalan pemohon dan pasangan (jika berkenaan)

- Salinan bil utiliti terkini (bil elektrik, air atau telefon).

AMAUN YANG DITAWARKAN

- RM1,000 sehingga RM10,000

TEMPOH PEMBIAYAAN

- Maksimum 3 tahun dengan penangguhan 6 bulan.

- Tiada caj yang dikenakan kepada pemohon.

PERTANYAAN LANJUT

- Hubungi no. 03 9059 8888

- E-mel cbrm@tekun.gov.my

- Layari laman web https://www.tekun.gov.my/

Passive Income – Free Talks

Free Talk : Passive Income

Your monthly salary not enough to cover your expenses?

Studying in colleges and looking for extra income?

To have more income to develop in life?

As a housewife, want to earn money from home?

Bayabumi Sdn Bhd organising a free event for people who want to earn extra income.

Passive Income- Free Talk. This event will conduct by Dr.Lavinsaa Doctorate in business & Chartered accountant. More than 5 years of experience in entrepreneur fields, business developments and branding.

This is a free talk, will benefits the entrepreneurs.

Don`t miss the chance and Seats are limited.

This is not a MLM Business Or Insurance talk.

Place: Level 3, Menara Axis, PJ

Date: 13 February 2020

Time: 2 pm to 4 pm

Join us by applying via the form below.

contacts us: 016-6385433

Whatsapp: 011-13346572

Benefits of Sdn Bhd -Free Talk

Free Talk : Benefits Of SDN BHD

Do you have plan to open Sdn Bhd company?

Upgrade your Enterprise company to next level?

You are Sdn Bhd company director but finding difficulty in moving forward?

Bayabumi Sdn Bhd organising an entrepreneur development event. Benefit of Sdn Bhd. This event will conduct by Dr.Lavinsaa Doctorate in business & Chartered accountant. More than 5 years of experience in entrepreneur fields, business developments and branding.

This is a free talk, will benefits the entrepreneurs.

Don`t miss the chance and Seats are limited.

Place: Level 3, Menara Axis, PJ

Date: 5 February 2020

Time: 2 pm to 4 pm

Join us by applying via the form below.

contacts us: 016-6385433

Whatsapp: 011-13346572

Business Start Up In Malaysia

Interested to Set up a company in malaysia ?

Finding difficulty in process of documentation, immigration, licenses and permit?

Looking for trustable Local Directors and Nominee Directors?

Looking for experienced Company Secretarial ?

How to avoid or Worry about fraud agents ?

This is talk for foreigners, who having a plan to open a company in Malaysia.

Business Start Up In Malaysia.

This event will conduct by Dr.Lavinsaa Doctorate in business & Chartered accountant. More than 5 years of experience in entrepreneur fields, business developments and branding. Successfully guided more than 50 foreign companies in Malaysia.

Don`t miss the chance and Seats are limited.

Place: Level 3, Menara Axis, PJ

Date: 4 February 2020

Time: 2 pm to 4 pm

Admission: RM50.00/per person

Accnt Details: Maybank 562900111268

Join us by applying via the form below.

contacts us: 016-6385433

Whatsapp: 011-13346572

Future Minds Networking (Kl)

Objective

1. Create fantastic networking opportunities

2. Building confident & leadership quality

3. Meet and build great relationship who can be your potential customers and able to generate referrals

4. Increase brand awareness

5. Exchange business idea

6. Satisfaction for helping others

Call 016-4445511

| Saturday, 16 November 2019 from 19:00-23:00 |

| Venue | Dynasty Hotel @ KL Malaysia218, Jalan Sultan Azlan Shah (Jalan Ipoh), 50300 Kuala Lumpur, Malaysia |

Future Minds Networking (KLANG)

Objective

1. Create fantastic networking opportunities

2. Building confident & leadership quality

3. Meet and build great relationship who can be your Potential customers and able to generate referrals

4. Increase brand awareness and exchange business idea

Call 012-5353 055 / 016-4445511

| Saturday, 12 October 2019 from 18:00-23:30 |

Business Start Up Expo

WHY SHOULD ATTEND THIS EVENT

People who have business ideas ?

Want to be your own boss ?

What to know about business ?

Can sustain their own income without depending on other support

3 Dates · 27 Sep 2019 – 29 Sep 2019 · UTC+08

Venue – Prangin Mall

33, Jalan Dr. Lim Chwee Leong, 10100 Pinang, Pulau Pinang, Malaysia.

Structuring It Right

The most efficient way to collect revenue is by restructuring your business properly.

Meet our speakers that will share with you their knowledge and experiences: Raphael Tay Wsf legal advisor and partner at Lee Hishammuddin Allen & Gledhill – Exploring legal structures for your business.

And Lavinsaa paramasivan wsf in-house company secretarial service provider – Registering your business and the importance of company secretaries

Hosted by World Startup Festival

Friday, 15 March 2019 from 09:00-12:30 PDT

Venue: World Startup Festival

WSF Hub, 7th Floor, WEB Digital, 159, Jln. Templer, Section 8 (14,211.49 km) 92614 Petaling Jaya, Malaysia

Sales and Service Tax (SST) in Malaysia

1. Definition

a. Service Tax

Malaysia’s Service Tax is a form of indirect single stage tax imposed on any provision of taxable services made in the course or furtherance of any business by a taxable person in Malaysia. The Service tax cannot be levied on any service which is not included in the list of taxable services prescribed by the Minister under First Schedule of the Service Tax Regulations 2018. A taxable person is a person who provides taxable services in the course or furtherance of business in Malaysia and is liable to be registered or is registered under the Service Tax Act 2018 (e.g. any individual, company, enterprise, partnership, club, trust body, co-operative society, association, etc.).

b. Sales Tax

The Sales Tax is a single-stage tax, charged and levied on taxable goods imported into Malaysia and on taxable goods manufactured in Malaysia by a taxable person and sold by him (including used or disposed of goods). In Malaysia, it is a mandatory requirement that all manufacturers of taxable goods are licensed under the Sales Tax Act 2018. A taxable person is a person who manufactures taxable goods and is liable to be registered if the annual turnover has exceeded RM500,000.00 threshold. Such a person is required to be registered under MySST system.

2. Tax Rate

a. Service Tax Rate

The Service Tax rate is fixed at 6%. A specific rate of tax of RM25 is imposed upon the provision of credit card and charge card services. Service tax is charged on:

• any provision of taxable services

• provided in Malaysia

• by a registered person

• in carrying on his business.

Service tax is not chargeable for imported and exported services under the STA 2018.

b. Sales Tax Rate

The sales tax rate is subject to 5%, 10% or to a specific rate (for petroleum) .

3. Taxable Services and Goods

a. Service Tax

Taxable services are any services which are listed in the various categories in the First Schedule of Service Tax Regulations 2018. The following taxable services are subject to the service tax:

- Hotel (incl. lodging house, service apartment, homestay, Inn, rest house, boarding house);

- Insurance and Takaful;

- Service of food and beverage preparation (include restaurant, cafe, catering, take-away, food truck, retail outlet, hawkers and etc.)

- Club (include Night club, private club, golf club)

- Gaming (include Casino, game of chance, gaming machines, lottery, betting)

- Telecommunication

- Pay-TV

- Forwarding agents

- Legal

- Accounting

- Surveying

- Architectural

- Valuer

- Engineering

- Employment agency

- Security

- Management services

- Parking

- Motor vehicle service or repair

- Courier

- Hire and drive car

- Advertising

- Domestic flight except Rural Air Services

- Credit or charge card

- IT services

- Electricity.

However, the service tax cannot be levied on any services that are not in the list of taxable service.

b. Sales Tax

Taxable goods are goods of a class or kind that are not being exempted from sales tax. Goods exempted from sales tax are listed in Schedule A of the Sales Tax (Goods Exempted From Sales Tax)

4. Registration and Cancelation

a. Service Tax

Any person who carries on a business of providing taxable service shall apply for registration under Section 13(1) STA 2018 as a registered person in the Form SST-01.

The effective date of registration shall be the first day of the month following the month the notification of liability is received or any earlier date agreed by the Director-General but not earlier than the date he becomes liable to be registered.

Application for registration shall be made online through the MySST Portal. Any person who is not required to be registered under Section 14 STA 2018 may apply to the Director General for registration voluntarily.

The Director General may register the said person if he is satisfied that the said person is providing taxable service but has not reached the threshold or is intending to carry on a business of providing taxable service.

Branch registration is allowed. Registration of branches or divisions may be considered if

• it is difficult to submit a single return for all the branches or divisions;

• each branch or division maintains a separate account;

• such branch or division is separately identifiable by reference to the nature of the business or its location and

• every separately registered branch or division has the same taxable period.

Any group registrations are not allowed. Generally, the service tax registration shall be cancelled by the Director General if the taxable person: • Ceases to carry on business of providing taxable services;

• Fails to provide taxable service by the date which the registration issued upon application for voluntary registration is to take effect;

• A company is dissolved.

b. Sales Tax

Every person engaged in the manufacturing of taxable goods in the course of business shall apply for a registration not later than the last day of the month following the month he is liable to be registered. He shall apply for a registration as a registered manufacturer in the SST-01 Form. The registration date shall be the first day of the month following the month the notification of liability is received or any earlier date agreed by the Director General (DG) of Customs but not earlier than the date he becomes liable to be registered. The registered manufacturer will be notified and assigned with a registration number.

5. Accounting for SST

The first taxable period of every taxable person shall begin from the date he should have been registered under section 13 STA 2018 and end on the last day of the following month and the subsequent taxable period shall be a period of two months ending on the last day of any month of any calendar year.

Starting a Business in Malaysia as a Foreigner

The Important First Few Steps:

Once you have decided Malaysia is the place to invest, the key points of “Starting A Business in Malaysia” will help you tie up the loose ends!

7 key points to consider before starting a business in Malaysia for foreigners:

1. What kind of business can I do? What am I passionate about? [Read: Businesses not permitted to foreigners]

2. Is my business idea feasible to conduct as a foreigner? Are they many opportunities to be explored in Malaysia?

3. The suitable business entity for foreigners for your business? What are the options of ownership for each entity available for foreigners? Is my business nature able to obtain 100% foreign-owned entity? Starting a Business in Malaysia As a Foreigner

4. Which trade licenses required for my business? My aim to start a franchise business – how to get started?

5. Am I guaranteed to be able to obtain all necessary approvals for trade licenses and work permit right after I register the company? This is the most crucial thing to know to avoid being stuck at the first step in your registration of the company itself!

6. What are the main costs involved in the registration of the company, set-up, trade licenses, and work permit?

7. What kind of problems generally faced by foreigners setting up a Malaysian company?

8. With this business, what are the visa options available for my family and myself? There are many kinds of work permits of different company structure for foreigners to chose, each has its own purpose and advantages. Check it out which structure suits you!

Example of the setup costs which may include the followings:

Company registration fee with Authorized Capital required for incorporation of a Malaysia Sdn Bhd Company

Trade licenses may be wholesale, retail trade (WRT) and local town council licenses for the premise and advertisement

In the case of a franchise business, your cost will include franchise, training and agreement fees

Deposit for office/shop space (usually amounts to 2 months of rental and 1-month utility fee)

Office/Shop renovation costs, types of furniture and fittings Starting a Business in Malaysia As a Foreigner

Initial deposit on opening a bank account. The minimum required ranges from RM1,000 to RM5,000 (varies with banks)

Cost of setting up landlines and broadband (deposit per line is roughly RM450)

For those interested using Malaysia as a regional business hub and interested to register a company in Malaysia. Here are six (6) keys questions:

1. What is the right type of entity?

2. What is the suitable structure should I have?

3. Do I need any trade licenses? Starting a Business in Malaysia As a Foreigner

4. How can I maximize the tax for my profit and personal tax?

5. How fast can the Company being formed complete with two (2) years’ work visa for me and my family?

6. What is the difference between local Malaysian Sdn Bhd Company and Labuan International Company?

LHDN’s new Tax Investigation Framework 2020

THE Inland Revenue Board Malaysia (LHDN) has issued a new Tax Investigation Framework 2020 to replace the Tax Investigation Framework issued on May 15, 2018.

The new framework, which took effect on Jan 1, 2020, is aimed at informing taxpayers about LHDN’s tax investigation procedures.

In general, the framework outlines the rights and responsibilities of officers, taxpayers and tax agents; assists taxpayers to fulfil their obligations, and informs taxpayers of the legal provisions relating to a tax investigation.

These are the key points.

Investigation Procedures

Request for Documents and Information

An investigation can be carried out by issuing letters requesting documents and information from the taxpayer, tax agents and third parties.

The taxpayer may be required to give information and an oral explanation at LHDN offices.

LHDN officers may also visit the taxpayer’s business premises with a written notification given prior to the visit.

Inspection Visit

Investigations can also be carried out by making an inspection visit without prior notice to the taxpayer’s business premises, residences, tax agent’s premises, third parties and other premises as necessary.

Examination of Documents

The LHDN officer will inspect the taxpayer’s business documents and/or personal documents. The inspection is to gather evidence of tax evasion and request any party to produce documents in his custody or control.

Record Statement

At least two LHDN officers will be present during the recording of statements from persons related to the case being investigated. Qualified lawyers can be present during the recording of statements as well.

Finalisation of Investigation

After completion of the investigation procedures, LHDN will issue a letter to the taxpayer confirming the finalisation of the investigation.

If a settlement is agreed upon, an agreement or letter of the undertaking will be signed.

The investigation is considered finalised after the case is approved by the DG of LHDN and an assessment is raised. Taxpayers who have been investigated will be monitored by LHDN.

If the taxpayer does not agree with the investigation findings, the DG may, according to the best of his judgement raise an assessment with a penalty.

Cases which are to be prosecuted will be forwarded to the legal department. Failure of a taxpayer to attend court proceedings after the summons is served may result in a warrant of arrest being issued.

Offences and Penalties

Failure to furnish, return or give notice of chargeability

Under subsection 112(1) of the Income Tax Act 1967 (ITA), taxpayers who fail to furnish the Income Tax Return Form (ITRF) for one year of assessment shall on conviction, be liable to a fine of not less than RM200 and not more than RM20,000, or imprisonment for a term not exceeding six months or both.

Whereas under subsection 112(1A), taxpayers who fail to furnish the ITRF for the period of two years of assessment or more shall, on conviction, be liable to a fine of not less than RM1,000 and not more than RM20,000, or imprisonment for a term not exceeding six months or both.

The taxpayer shall also pay a special penalty of three times the amount of tax which has been undercharged.

If no prosecution has been instituted in respect of failure to furnish a return or give notice of chargeability, the DG may require the taxpayer to pay a penalty three times the amount of tax which has been undercharged as under Section 112(3) of the ITA.

Incorrect returns

Making incorrect return by omitting or understating any income of which the taxpayer is required to make a return on behalf of himself or another person, or gives any incorrect information in relation to any matter affecting his own changeability to a tax of any other person is an offence under Section 113(1) of the ITA.

Taxpayers guilty of the offence shall, on conviction, be liable to a fine of not less than RM1,000 and not more than RM10,000 and shall pay a special penalty of double the amount of tax which has been undercharged.

If no prosecution has been instituted in respect of the incorrect return or incorrect information, the DG may impose a penalty equal to the amount of the tax which has been undercharged as under Section 113(2) of the ITA.

Wilful evasion

Under Section 114(1) of the ITA, the taxpayer guilty of the offence shall, on conviction, be liable to a fine of not less than RM1,000 and not more than RM20,000, or imprisonment for a term not exceeding three years or both, and shall pay a special penalty of three times the amount of tax which has been undercharged.

Investigation under Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLATFPUAA).

Failure to furnish ITRF (Section 112 of the ITA), make incorrect returns (Section 113 of the ITA) and wilful evasion (Section 114 of the ITA) are listed as serious offences under Second Schedule of the AMLATFPUAA.

LHDN may take action to deter, detect and investigate cases of money laundering related to serious offences.

Upon conviction of money laundering offence under Section 4 of the AMLATFPUAA, a person shall be liable to imprisonment for a term not exceeding 15 years and shall also be liable to a fine of not less than five times the sum or value of the proceeds of unlawful activity or instrumentalities of an offence at the time the offence was committed or RM5 million, whichever is the higher.

Investigation under AMLATFPUAA and investigation under ITA may be conducted separately or concurrently.

LHDN officers may exercise powers under AMLATFPUAA such as:

- Enter any premises without a search warrant.

- Search the premises for any property, record, report or document.

- Inspect, make copies of or take extracts from any record, report or document.

- Take possession of any property, record, report or document seized and detain it for a period deemed necessary.

- Search any person who is in, or on such premises.

- Break open, examine and search any article, container or receptacle.

- Stop, detain or search any conveyance.

- Break open any outer or inner door of such premises or conveyance.

- Remove by force any obstruction to such entry, search, seizure, detention or removal.

- Detain any person found on such premises, or in such conveyance until the search is completed.

- Order any person believed to be acquainted with the facts and circumstances of the case to attend before the LHDN officer for examination.

- Arrest without warrant a person suspected to have committed or to be committing any offence under AMLATFPUAA.

- Issue an order to freeze any property, such as bank accounts, of any person who is suspected of committing a serious offence.

Responsibilities of taxpayer investigated under AMLATFPUAA:

- Allow the LHDN officer to access any premises and submit to the search of his person.

- Attend before the LHDN officer for examination.

- Answer any question put to him by the LHDN officer.

- Furnish any information or statement as requested by the LHDN officer.

- Cooperate and comply with any lawful demands by the LHDN officer in the execution of his duties.

- Not to conceal and to give the LHDN officer any property, record or information which may reasonably be required of him and which he has in his power to give.

- Not to destroy any property, record, report or document in order to prevent its seizure or the securing of the property, record, report or document.

A person who fails to comply, if convicted under section 34 of the AMLATFPUAA, shall be liable to a fine not exceeding RM3 million or imprisonment for a term not exceeding five years or both.

In the case of a continuing offence, he shall be liable to a further fine not exceeding RM3,000 for each day during which the offence continues after conviction.

Benefits of Online Accounting Software

In every business, whether it is small or big, it requires constant attention so that the business can run smoothly. Among all these elements, accounting and bookkeeping method is an important one. It takes huge efforts to maintain the accounts and it is also a time-consuming job. So, a pleasant solution to this problem is using online accounting software. This online accounting software will calculate the cash flow, revenue and so on precisely and accurately. Further, your financial information will be safe, and you can access it from any corner of the world. Hence, it is a great investment for the business, specifically for small business, where the fund is limited.

There are several other benefits of online accounting software too.

Online Accounting Software – User-Friendly

It is very easy to learn, and one can easily adopt these practices in day to day operations. Once you set up is ready, only a few entries will help you in keeping accounts up to date. All the information from the invoices and bank statements can be uploaded automatically and will be processed into the right category. So, from now onwards, you need not to worry about the advanced accounting too. You can efficiently maintain accounts of your business just by making a few clicks. Maintaining data becomes easy for you and in fact, you are not required to devote lots of time in it.

Payroll

Online accounting software makes work easy for you. It just eases your work of filling out the information of employees timely and accurately.

Online Accounting Software Security

Online accounting software keeps the data online, so, you might be worried about its security. But, keep in mind that the security of your data is the topmost priority of these online business software companies. Hence, security is not your concern. It is always beneficial to assess the financial health of your company at any time. The online connection makes work easy for you like easily you can invoice your clients. When you think of the security of data, many people still think of outsourcing any accountant to keep their accounts. But, this software is the safe place to keep data intact and safe.

Online Accounting Software Cash Flow

When you efficiently maintain the cash flow, then you can save money effectively. The online accounting software will make the process simple to determine incentives for the employees. It will also determine discounts for the customers and creditors. Further, you can easily comprehend profit as well as losses.

Cost-Effective

Online accounting software is the most cost-effective and affordable way to maintain your business accounts. In house software as well as outsourcing accountant can cost you a large sum of money. But the online accounting software will not cost you much. They are not expensive. So, you can manage your business accounts in a cost-effective manner.

Automated Record Keeping

The main problem with financial management is that it is labor intensive and confusing. So, one needs an expert to handle all these accounting problems. But with online accounting software, there are features which will compile all your data in different categories. They will merge all the data and information in an operating system. In fact, the online accounting software are able to analyze the business practices and will display the trends of money flow in your company. You can easily maintain and create financial reports with much fewer efforts. You can do the following easily:

- Automatic Data Backup

- Check Printing

- Budgeting and Forecasting

- Cost Predictions

- Comment Capabilities

- External Application Integration

- Customizable Reports

- Payroll Management

- Fund Accounting

- Password Protection

- Inventory Management

Accounting is always an integral and essential part of any business. The business constantly needs accurate financial information. This information helps them in making business decisions. So, the online accounting software will serve the purpose and will provide the correct information. Switching to online accounting software will give them many benefits. Running the business with the right tools are always beneficial. A single mistake in accounting can cost you a big loss. But the online accounting software will keep you away from such mistakes. So, it’s the time to switch to online accounting software. No need for hiring an accountant for all your accounting purpose. Enhance your productivity with the online accounting software.