Category Archives: Blog

FSA2.0 Is Now Available at Maybank!

Application of FSA2.0 is now available via Maybank! Users can now apply FSA2.0 through Maybank MYFSA2u by using the EPF Account 2 savings as proof to loan between RM3,000 to RM50,000, with an interest rate of 4.75% p.a. Members only need to pay a minimum monthly installment of RM32, and no guarantor or additional fees are required.

Boost e-Wallet will Start Charging Top-up Fees Soon!

Starting from March 15, Boost e-wallet will start charging a 1% processing fee to users who top up using credit cards. However, the first RM1,000 top-up amount is exempt from processing fees. Besides, the previous maximum top-up limit of RM2,000 will be lifted.

For example, if a user tops up RM1,200, the first RM1,000 will be exempt from processing fees, while the remaining RM200 will incur a 1% processing fee, which is RM2.

Deadline for Malaysia Income Tax Submission in 2024

1. Form EA

Annual income statement prepared by company to employees for tax submission purpose

Deadline: 29.02.2024

2. CP 58

Commission / fees statement prepared by company to agents, dealers & distributors

Deadline: 31.03.2024

3. Form E

Form used by company to declare employees status and their salary details to LHDN

Deadline: 31.03.2024 (30.04.2024 for e-filing)

4. Form BE

Income tax return for individual who only received employment income

Deadline: 30.04.2024 (15.05.2024 for e-filing)

5. Form B

Income tax return for individual with business income (income other than employment income)

Deadline: 30.06.2024 (15.07.2024 for e-filing)

6. Form P

Income tax return for partnership

Deadline: 30.06.2024 (15.07.2024 for e-filing)

7. Form C

Income tax return for companies

Deadline: 7 months after financial year end (8 months for e-filing)

8. Form PT

Income tax return for LLP

Deadline: 7 months after financial year end (8 months for e-filing)

Employers’ Tax Obligations

Understanding Form E & C.P.8D

As an employer in Malaysia, you have various tax obligations and duties that require compliance. Among these, one crucial responsibility is submitting Form E and C.P.8D to the Inland Revenue Board (IRB).

This article will outline your obligations as an employer and underscore the risks associated with non-compliance.

What is Form E & C.P.8D?

Form E is a declaration form that all employers must complete and annually submit to the IRB. It serves primarily to report employee-related information, including the total number of employees as of December 31st, new hires and departures during the year, as well as detailed employee data.

On the other hand, Form C.P.8D is a comprehensive report enabling employers to declare company details and the remuneration paid to each employee throughout the year. It requires employers to record and report various information, such as total deductions claimed and specific tax deduction particulars, irrespective of employees’ contract types (e.g., full-time, part-time, interns, or fixed-term).

Who should submit Form E & C.P.8D?

Form E is typically considered complete only when Form C.P.8D is submitted before or by the due date. However, many employers often grapple with understanding their obligations regarding these forms. A common issue arises regarding whether employers without any employees are still mandated to submit these forms.

In reality, companies (including dormant ones), limited liability partnerships, trust bodies, and cooperative societies are obligated to furnish Form e-E and C.P.8D, regardless of their employment status.

For sole proprietorships or partnerships without employees, Form C.P.8D submission is unnecessary. Nonetheless, the submission of Form E remains mandatory, regardless of employment status. In essence, every employer must submit Form E, and exemptions from Form C.P.8D submission are granted only to specific categories of employers.

The due date for submission of Form E & C.P.8D

Starting from the Year of Assessment (YA) 2023, Form E and C.P.8D submission must be done electronically via e-Filing. Manual submissions are no longer accepted, and only Employers, Employers’ Representatives, or Tax Agent e-Filing System (TAeF) roles for certified tax agents are permitted.

Employers must submit Form E and C.P.8D by the statutory deadline, March 31, 2024. Fortunately, a one-month grace period is provided, allowing filing until April 30, 2024.

Non-compliance and penalties

Failure to prepare and file Form E & C.P.8D by the deadline may result in fines ranging from RM200 to RM20,000, or imprisonment for up to 6 months, or both, under the Income Tax Act 1967 – Section120(1)(b).

In summary, employers play a crucial role in accurately declaring employee information to the IRB via Form E. Timely and accurate submissions are essential to avoid penalties.

FYE Submission Deadline

Financial Statement (Audited)

You will need to hire an actual certified auditor to come in and prepare these documents for you. They will need to have a look at your management accounts and your bookkeeping records for that financial year.

You need to ensure that you keep a very close eye on all the receipts and transactions because they will be used to balance out your financial statements. An error there will cause your numbers to be unbalanced and may subject you to an inquiry by the government.

Your failure to comply with this requirement is an offence that is punishable with a fine not exceeding RM 5000 or an imprisonment for a term not exceeding one year or both.

These offences are really serious and we want to make sure that you never get caught in a situation like that ever. SSM has released a new tool called MBRS – which helps companies submit their annual reports online. MBRS will be mandatory for all companies to use when it comes to submitting these documents in the next year.

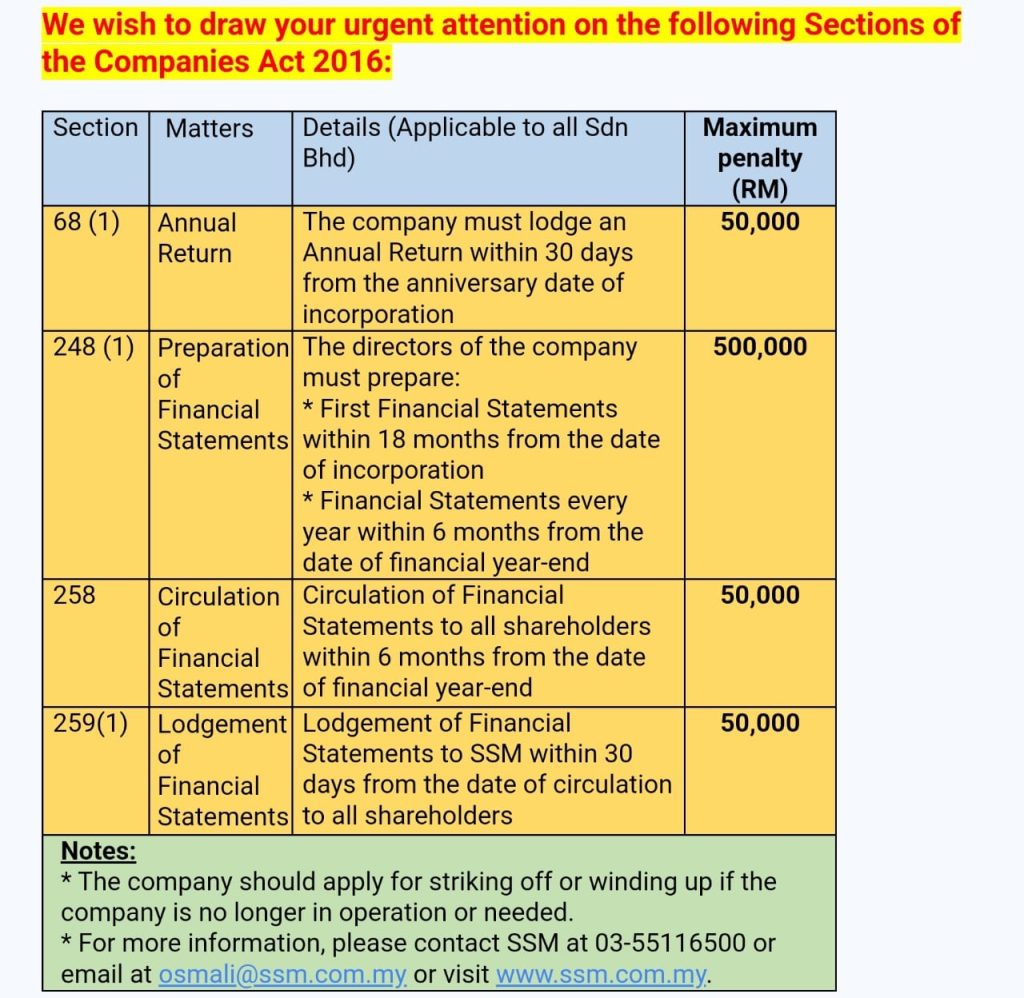

Annual Statutory Compliance Documents for SSM Malaysia

When you start your own business, there are a lot of things that you need to make sure you have covered. Sometimes, one or two important things are missed out because you’re super busy getting everything working.

These things will include your business strategies, marketing plans, cash flows and budget projections. However, there are a few things that you might forget and that is your annual statutory compliance documents for SSM. Some of these documents are compulsory and it might not be your top priority at the moment but you will need to adhere to the rules as they are bound by legislation. Failure to comply will result in fines.

As a private limited company or more commonly known as a Sdn Bhd company, you are required by law to send in multiple documents to SSM at the end of your financial year.

So what are these documents?

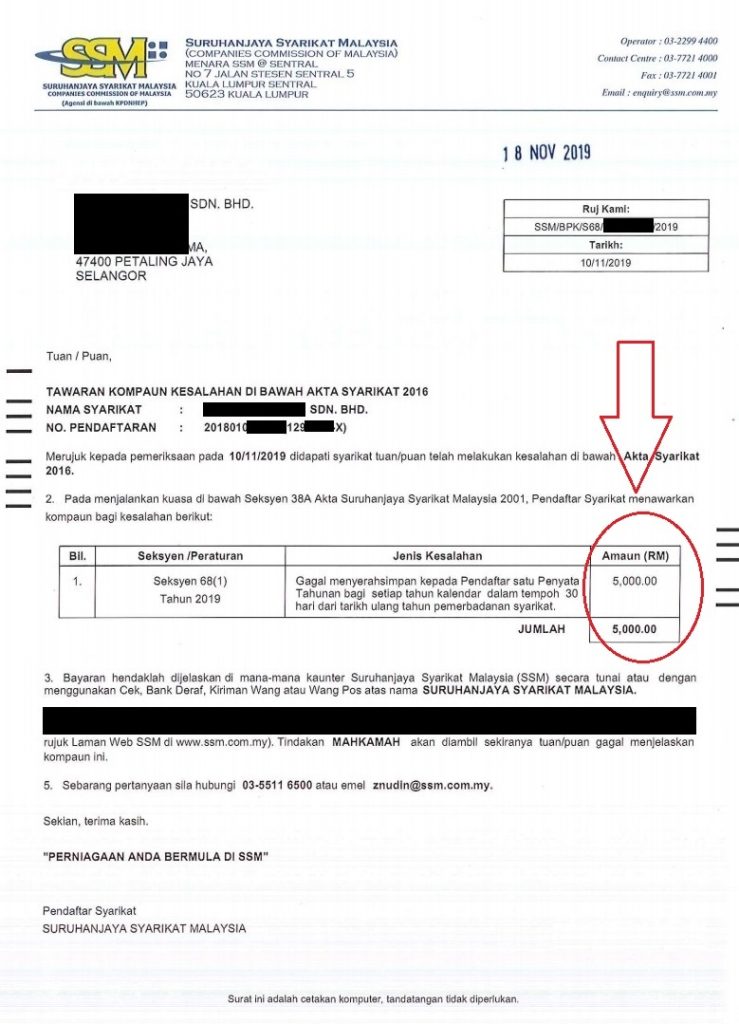

Document 1 : Annual Returns

Every private limited company must submit their annual returns for each financial year to the SSM no later than 30 days from the yearly anniversary of the incorporation date. In this annual return document, you need to basically notify SSM of your yearly returns and also inform them if there has been any material changes. Usually a corporate secretary will be there to aid in submission of these documents.

Failure to comply will render you punishable by the law with a fine not exceeding RM 5000, and a further fine of not exceeding RM 1000 for each day when the offence continues.

Document 2 : Director’s Report

Your directors’ report will need to be prepared by the director’s in your company at the end of the financial year. You would also need to attach your financial statements.

The directors’ report includes :

- Names and details of all current and past directors of the company.

- The principal activities carried out by the company.

- The net amount of profit and loss, basically this is your profit and loss sheet.

- Shares or debentures

- Any other information that might be required under the Companies Act 2016.

If there is a failure on your part to prepare the directors’ report, you will be punishable with a fine not exceeding RM 500,000 or imprisonment for a term not exceeding 1 year or both. Failure to comply with this requirement also renders it an offence by the company and is punishable with a fine not exceeding RM 20,000.

Document 3 : Financial Statement (Audited)

You will need to hire an actual certified auditor to come in and prepare these documents for you. They will need to have a look at your management accounts and your bookkeeping records for that financial year.

You need to ensure that you keep a very close eye on all the receipts and transactions because they will be used to balance out your financial statements. An error there will cause your numbers to be unbalanced and may subject you to an inquiry by the government.

Your failure to comply with this requirement is an offence that is punishable with a fine not exceeding RM 5000 or an imprisonment for a term not exceeding one year or both.

These offences are really serious and we want to make sure that you never get caught in a situation like that ever. SSM has released a new tool called MBRS – which helps companies submit their annual reports online. MBRS will be mandatory for all companies to use when it comes to submitting these documents in the next year.

PRIHATIN Moratorium Programme – Tax Treatment for Interest

The Income Tax, also regarded as Special Treatment for Interest on Loan 2020, was gazetted on 25 Aug 2020. These special regulations will be in effect from year of assessment 2020 onwards.

The special treatment of interest is gazetted under the PRIHATIN Moratorium Programme to support various causes. It is basically to protect people, support businesses, and benefit small contractors with the needed economic stimulus.

The right to exercise regulations under the tax treatment is to be given to different authorities, which include the following:

- Licensed investment banks and licensed banks that are under the Financial Service Act 2013

- Licensed Islamic banks that are under the Islamic Financial Service Act 2013

- Every prescribed development financial institution that is under the Development Financial Institutions Act 2002 (a ‘financial institution’)

They all are authorized for the tax treatment of the interest due and payable in respect of loans. The loans should be related to the moratorium program under the PRIHATIN Economic Stimulus Package (PRIHATIN).

Regulation 4(1) of the Regulations under the PRIHATIN Moratorium Programme provides that where a financial institution approves the moratorium in respect of interest due and payable from 1 April 2020 until 30 September 2020, the interest shall not constitute the gross income of that financial institution in the basis period for that year of assessment. If the moratorium from a borrower is under a loan granted by the financial institution in the base year of assessment, the interest is not calculated in the gross income of the financial institution.

However, where interest concerning regulation 4(1) is received from 1 April 2020 until 30 September 2020 or becomes receivable on or after 1 October 2020 shall be treated as total income in the basis period for an assessment year.

Here are the following conditions that apply to a loan and moratorium under these Regulations:

- The loan has to be in Ringgit.

- There should be no outstanding payment on the loan by the borrower for more than 90 days as of 1 April 2020.

- The borrower company which could be other than small and medium enterprises must have applied for the moratorium in the relevant financial institution.

- According to the Income Tax Act 1967, no deduction from the gross income of a financial institution is allowed based on any impairment of a loan involved in the period of the moratorium program referred to in regulation 4(1).

- The financial institution has to maintain a separate account for the amount of interest treated under the PRIHATIN Moratorium Scheme and payment received concerning the interest referred to in regulation 4(1) of the scheme.

Do Away With Starting a New Business and Simply Buy Over Existing Ones

Advantages of Buying Over

You get to acquire existing goodwill such as customer base, marketing leverage, employees and infrastructures. Costs for operating an existing business is also much lower than a new one. Plus, a current company could also have patents, trademarks or copyrights, which are valuable to business expansion.

Checklist for Buying Over

Once you decide to buy over an existing business, you have to start with a due diligence checklist. An example could look something like this:

- Business Reputation: You can find out more about the business reputation by talking to its competitors. You could also weed out potential problems if any of them mentions it.

- Financial Disclosure: You may need to hire a lawyer and an accountant for this process. With a complete financial document, you get to understand the company cash flow and make a better evaluation.

- Assets and liabilities: Most companies would have tangible and intangible assets as well as obligations. It is essential to understand what you are about to face when you take over. For instance, intangible assets are intellectual property that the company owns. The target company could also have innovations not yet patented.

- Essential contracts: The target company could have sustained due to multiple reasons. One of them is having useful agreements with suppliers, vendors, landlord, and key employees.

- Licensing and permits: If the target company operates within an industry, surely it has to comply with industry regulations. Hence, the company should have proper permissions and licensing to operate.

Process of Buying Over

Now that you are more determined to buy over that business, follow the process to get things going.

Step 1: Negotiate

Start negotiating with the seller or business owner. Negotiations go beyond the price, and it should comprise of whether the takeover is an asset takeover or equity acquisition. As a buyer, you should also take note of employee condition and any particular condition that must occur before the complete sale. Asset acquisition is buying over selected company assets to ensure continuous operation. Equity acquisition is buying over the significant shareholding in the company. During this stage, you, through your lawyer, can prepare the “Letter of Intent” stating all material aspects agreed upon. This is only as a basis before drafting an agreement. In the letter, you should also include a statement that negotiations are exclusive to both parties. This means that either party cannot go into negotiations with others simultaneously.

Step 2: Drafting the Agreement

Your lawyer should now draft the sales and purchase agreement (SPA) detailing all issues. Most of the time, more negotiations follow throughout this process. As a buyer, this is where you require warranties for all matters. For instance, the seller should assure that all financial records are complete and accurate. Other matters may warrant for work in progress, vendor contracts and current employees.

Step 3: Notify SSM

When you have completed the business sale, you would have to notify the SSM in Malaysia. This process must complete within 14 days to inform them of any changes to the business’ name, the appointment of office director, change of shareholding and registered address if any.

How Digital Tax affects Malaysians

The scope of digital tax is broad as it covers almost all online services provided digitally such as online software licensing, video and music streaming, digital advertising, video games, mobile applications, etc. Any service that is delivered or subscribed over the internet or electronic network would fall within the scope of digital tax.

Consumers who acquire or subscribe to these services would find themselves having to bear an additional 6% service tax imposed by their suppliers who are required to register with the Royal Malaysian Customs Department. However, not all suppliers are required to register. Those with annual sales of RM 500,000 or more would have to, but suppliers with fewer sales would not have to register. The question is whether the latter suppliers would cash in by raising their prices.

A common misconception by the general public is such that digital tax would be imposed on the purchase of tangible goods via online platforms such as online purchases. This is not true as the purchase of tangible goods or products (ie non-digital products) would fall outside the ambit of digital tax notwithstanding that the purchases are transacted online.

For example, the purchase of a computer via online platforms would not be subject to digital tax on the premise that the computer is not a digital product/service. However, this does not mean that the purchases made online on tangible goods are tax-free as most goods would be subject to sales tax, including imported goods.

By and large, the average Malaysian household should not be significantly impacted given that the adoption rate of e-commerce among Malaysians is only 51.2% – based on the survey conducted by Malaysian Communications and Multimedia Commission in 2018. Moreover, a typical consumer tends to spend more on tangible goods rather than on digital services.

The impact on the tax on someone who subscribes to all the above services would be RM61.12 a year. This might not seem large by itself, but as a tax, it becomes a burden.

Almost all online services would be subject to digital tax but in an effort to reduce the burden of the Rakyat and to cultivate learning, the authorities have granted exemption on online education services such as distance learning conducted by qualified institutions. An exemption has also been granted on e-newspapers, online journal and periodicals.

To sum up, Malaysia joined the bandwagon to be one of the early adopters of digital tax alongside with, among others, countries such as Australia, Japan, South Korea, New Zealand and Singapore, with the objectives of creating a level playing field, as well as to increase revenue from the untapped digital economy. It is reported that the global digital economy is currently worth a whopping US$3 trillion. This is another avenue for the Government to raise revenue. Whilst this may not be significant now, it could increase as we find that digitization would grow exponentially over time.

How to Register Sdn Bhd Company in Malaysia?

What is Sdn Bhd Company?

Sdn Bhd, is an abbreviation of a Malaysian term Sendirian Berhad, which means a Private Limited company. This type of company is quite popular among businessmen in Malaysia.

According to the Companies Act 2016, Sdn Bhd Company can only be registered unless it has appointed 1 director and 1 shareholder. Meaning thereby, you can easily register a Sdn Bhd company in Malaysia without engaging a business partner.

Below are the noteworthy features of Sdn Bhd Company.

- This type of company is limited by share. Meaning thereby, if an Sdn Bhd company declares a total loss, the shareholders and company secretary of such a company won’t be liable to the company shares.

- Sdn Bhd Company holds the right to conduct its perpetual succession until shareholders, directors, or company secretary dissolves the company.

- All such companies can sue any other individual or company. Similarly, any other individual or company can also sue an Sdn Bhd company.

- Sdn Bhd Company is free to enter into contracts with other companies and perform legitimate business activities.

What is the Difference between Berhad and Sdn Bhd?

If you don’t have any idea as to what are the major differences between a Berhad (Bhd) and a Sendirian Berhad (Sdn Bhd) company, just take a look at the information provided below.

To start with, let’s discuss the names of these companies and their meaning. The term Sendirian Berhad (Sdn Bhd) means a Private Limited Company.

On the contrary, a Berhad (Bhd) company is a Public Company. Normally, public companies are listed on a stock exchange, rendering them as the public listed companies.

Given below are the most prominent differences between Sdn Bhd and Bhd companies.

1. Availability of the shares to the public

A public company (bhd) allows the public to own its shares without any prior permission. On the other hand, people can only own the shares of a private limited company (Sdn Bhd) after the approval or agreement of its existing shareholders.

2. Number of shareholders

A public company (bhd) is permitted to have an unlimited number of shareholders. Whereas, a private limited company (sdn bhd) cannot have more than 50 shareholders.

3. Publication of financial information

The financial information of a public company (Bhd) is accessible to the public. Moreover, public listed companies are also bound to hold quarterly earnings calls.

Such a company needs to answer the queries of its public shareholders. On the contrary, a private limited company (Sdn Bhd) isn’t required to the public its financial information.

4. Standards for financial reporting

The most notable difference between a private limited company (Sdn Bhd) and a Public company (Bhd) is related to their financial reporting standards. Public companies have to follow a higher financial reporting standard as compared to the private limited company.

How to Register a Sdn Bhd Company in Malaysia

Here is a step-by-step instruction about registering an Sdn Bhd company in Malaysia.

Step-1: Go to the online portal of MyCoID and register an account.

Step-2: After activating the account, you will receive an email, which provides essential information for validating the account at the nearest SSM counter.

Step-3: Once SSM validates your account, the next step is to login to the MyCoID portal and start the process of registering your Sdn Bhd company.

Step-4: Next, go to the Direct Incorporation Application to perform the Name Search procedure. To initiate this procedure, you need to provide the three proposed names for the company.

If another company has already taken the proposed name, it won’t be possible to proceed further with the registration process.

Step-5: After that, a Super Form will open on your computer screen. This form allows you to clarify the meaning of the proposed company name.

It is mandatory to fill this form if the proposed name contains the controlled words, names of states, or trademark. In this case, you are also bound to provide an authorization letter from the relevant authority or owner.

Step-6: Now it’s time to choose a business code. This is a code that provides both the business address and registered address of your company.

Step-7: Till this stage, the system will list you as a shareholder or director of the company. However, if you want to add these details manually, you can do it in the next step.

Step-8: Apply after carefully reviewing the information provided by you. From here, you will be directed to the ‘Transaction page’.

Step-9: For completing the registration procedure, you have to pay RM1,000 as a registration. Don’t forget to collect the transaction receipt.

Step-10: Once done, the ‘Notice of Registration’ will be sent to you via email. It would serve as proof of registration. In addition, you can also obtain a Company Certificate by paying the required fee at the SSM counter.

Note: After registering a company with SSM, you are bound to appoint a company secretary within 30 days. You can do it through MyCoID portal. Although it isn’t binding or mandatory to lodge a constitution of your Sdn Bhd company, you can do it via MyCoID portal if you want to.

What are the Requirements to Register a Sdn Bhd Company in Malaysia?

The most essential aspects to consider when registering an Sdn Bhd company in Malaysia are mentioned below:

- Name of the Company

- What type of business activities it would perform

- Must have a registered office in Malaysia

- The company should have one director and one shareholder.

- Need to hire a corporate secretary, who is either licensed by SSM or a member of a prescribed professional body.

- The lowest amount of paid-up capital is RM2

- You have to provide a copy of every essential document. For instance, copies of identification cards or passport of the director and shareholder must be attached to the file.

Eligibility Requirement for a Sdn Bhd Company

In order to run the company, it requires the appointment of at least 1 shareholder and 1 director who lives in Malaysia. Both the director and shareholder could be the same person.

- The age of both the shareholder and the director should not be less than 18 years old.

- Moreover, the person has not been convicted within the last five years.

- Bankrupt or a person not the resident of Malaysia isn’t eligible for such designations.

How long does it take to Register Sdn Bhd Company?

Generally, it takes 1 to 2 weeks for getting your Sdn Bhd Company registered. Below is the estimated time that each process might take for its completion.

- It takes 1 working day for competing for account registration & activation, as well as the “Company Name Search” procedure.

- You require 2-3 days for preparing the registration documents

- The signing of all the relevant documents by shareholders and directors can take 1 working day

- You need 3-5 days for submission of documents to SSM

- Obtaining the Digital incorporation certificate by SSM takes only 1 day

The time mentioned above is an estimated one, which means you may have to face delays if the SSM requires some kind of additional information. For instance, SSM might require additional time to verify the registration documents.

It is binding on the owner of a prospective company to carefully provide the information. This is so, as even the slightest mistake could result in an unexpected delay.

How much it takes to Register Sdn Bhd Company?

Here are the two major expenses of registering a Sdn Bhd company in Malaysia.

- The cost of registering Sdn Bhd RM1499

- The company secretary fee is RM200 per month

Company Secretarial Services

With a view to registering a Sdn Bhd company in Malaysia, you need to appoint a company secretary. A company secretary is responsible for performing a variety of essential tasks.

For instance, a secretary needs to:

- Deal with regulations

- Create company policies

- Handle the aspect related to the following industrial standards

- Follow up of the company’s guidelines and code of ethics

- Take into account any other regulations mentioned in the Malaysia Companies Act 2016

This is all about register a Sdn Bhd company in Malaysia. We hope you enjoyed the read. If you need

How COVID-19 May Permanently Affect HR

More Employees Working Remotely

The beginning of COVID-19 brought about more organizations than any time in recent memory offering far off work as well as requiring it. While a few organizations accomplished offer distant work as an advantage, many didn’t, wanting to keep representatives in the workplace. Notwithstanding, presently that any organization that can has executed the innovation and framework to deal with representatives working distantly, more individuals will keep on working distantly even after the pandemic is finished.

This is uplifting news for some workers. There are numerous who can profit by working distantly, including the individuals who have an incapacity, the individuals who need adaptable planning, those with long drive times, and that’s just the beginning. It’s additionally uplifting news for organizations. The more staff can work distantly, the lower the workplace overhead expenses might be.

I’m not catching This’ meaning for HR?

While for some HR experts, overseeing telecommuters is the same old thing, a few organizations should actualize new guidelines and cycles. It’s imperative to create rules for far off work as quickly as time permits. Formal cycles for taking care of distant work will help guarantee that the organization keeps on running easily while the pandemic is as yet going on.

These guidelines for far off work will have been tried and balanced as vital during the pandemic. Once the Covid pandemic is finished, they can stay set up for any individual who keeps on telecommuting.

Difficulties Keeping Employees Engaged

The COVID-19 pandemic is trying a ton of organizations’ capacity to react to crises. Organizations that didn’t already have any framework set up for distant work needed to execute the innovation in a rush. In a pandemic that undermines the lives and soundness of representatives just as their occupations, it’s significant for organizations to show that they care about their workers.

Workers are more connected with when they feel that their organization thinks about their prosperity. On the off chance that an organization’s reaction to the pandemic caused workers to feel disposable or that they didn’t make a difference to the organization, they’ll feel less connected with and, accordingly, be less gainful. The pandemic is a troublesome time for everybody and a few organizations were needed to make staffing cuts due to lost income.

It might be troublesome, yet it’s critical to show your workers that the organization cares. Keeping up a notoriety for thinking about your staff will help keep current representatives connected with, yet in addition help for future enrolling and for maintenance.

Enlisting Will Also Be Remote

As opposed to directing face to face meets, the whole enrollment cycle will probably keep on being far off. Occupation looking and applying are now done on the web. Advanced innovation empowers video conferencing for interviews from anyplace. With far off work conjecture to proceed after the finish of the pandemic, it benefits organizations to keep selecting distantly too.

Particularly if the position you’re hoping to fill should be possible distantly, far off meetings will permit organizations to enlist from anyplace instead of just locally.

Re-Thinking Sales Strategies to Boost Client Base

- Find Your Niche

Before you start creating your advertising pipes and building deals methodologies, it’s essential that you distinguish who your optimal client is and what you’re generally enthusiastic about. By distinguishing the business wherein your optimal customer is working, you’re ready to straightforwardly focus on that particular customer, yet additionally learn more data about their field. The more information you get, the more prominent your odds of pulling in more organizations inside a similar industry as you leverage your expertise and understanding to convey important administrations.

- Educate Your Target Client

As your insight into your objective customer and their industry develops, progress in the direction of situating yourself as an idea chief. You can accomplish this by displaying your bits of knowledge with educational and informative substance.

While this may appear to be a brisk method to lose expected customers, given the supposition that on the off chance that you give somebody the data they have to achieve an assignment themselves they will do as such, this isn’t the situation. In all actuality, your intended interest group as of now approaches the data you’re giving them. What they’re hoping to is somebody who has a demonstrated history of taking this data and utilizing it to effectively actualize arrangements.

- Be Transparent

Straightforwardness is a key segment to both drawing in and holding customers. At our firm, the business meeting we have with a potential customer is regularly an exploratory call where we become acquainted with additional about the customer’s business, their requirements, and why they came to us.

We have likewise settled a cycle that permits us to recognize administrations we accept the customer would most profit by, just as their expense, continuously. The customer is vigorously engaged with deciding their custom cost dependent on the administrations they select. Like purchasing a vehicle, they can choose the base alternative, on that is completely stacked or something in the middle. It’s a similar vehicle, it simply has various alternatives.

The customer picks the alternative that best meets their requirements. This degree of straightforwardness precisely speaks to our qualities and promptly sets up a specific measure of trust among us and the possible customer, which ordinarily prompts us bringing the deal to a close.

- Keep Your Process Simple

The business instrument we’ve made at our firm is sufficiently basic to where different colleagues effectively pitch administrations and articulate their separate expenses to clients and think of a similar dollar sum. This instrument is especially valuable since it permits us the adaptability to certainly remember important staff individuals for deals calls regardless of whether they don’t have broad deals understanding.

The effortlessness is additionally significant in light of the fact that the individual we’re talking with commonly doesn’t have a clue about the responses to itemized addresses, for example, what number Quick-books exchanges do you have in a month?

The kinds of inquiries we pose are ones that a proprietor would realize directly all things being equal or can make a sensible speculation. Keeping up this degree of access and adaptability has been one more factor that has helped us land new customers and urged current customers to build the quantity of administrations we’re giving them.

Making an effective deals technique comes down to making sense of what addresses your objective customer and how to best speak to your organization. From that point, utilizing the tips here can make you another stride nearer to making sure about more qualified leads and expanding customer maintenance.