When you start your own business, there are a lot of things that you need to make sure you have covered. Sometimes, one or two important things are missed out because you’re super busy getting everything working.

These things will include your business strategies, marketing plans, cash flows and budget projections. However, there are a few things that you might forget and that is your annual statutory compliance documents for SSM. Some of these documents are compulsory and it might not be your top priority at the moment but you will need to adhere to the rules as they are bound by legislation. Failure to comply will result in fines.

As a private limited company or more commonly known as a Sdn Bhd company, you are required by law to send in multiple documents to SSM at the end of your financial year.

So what are these documents?

Document 1 : Annual Returns

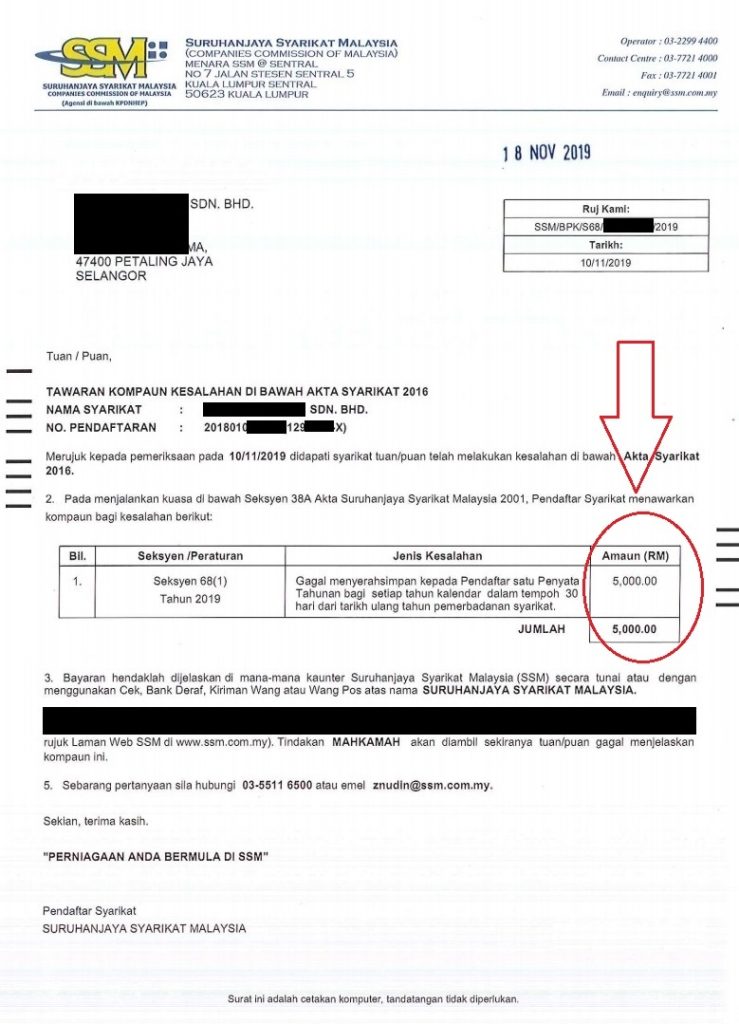

Every private limited company must submit their annual returns for each financial year to the SSM no later than 30 days from the yearly anniversary of the incorporation date. In this annual return document, you need to basically notify SSM of your yearly returns and also inform them if there has been any material changes. Usually a corporate secretary will be there to aid in submission of these documents.

Failure to comply will render you punishable by the law with a fine not exceeding RM 5000, and a further fine of not exceeding RM 1000 for each day when the offence continues.

Document 2 : Director’s Report

Your directors’ report will need to be prepared by the director’s in your company at the end of the financial year. You would also need to attach your financial statements.

The directors’ report includes :

- Names and details of all current and past directors of the company.

- The principal activities carried out by the company.

- The net amount of profit and loss, basically this is your profit and loss sheet.

- Shares or debentures

- Any other information that might be required under the Companies Act 2016.

If there is a failure on your part to prepare the directors’ report, you will be punishable with a fine not exceeding RM 500,000 or imprisonment for a term not exceeding 1 year or both. Failure to comply with this requirement also renders it an offence by the company and is punishable with a fine not exceeding RM 20,000.

Document 3 : Financial Statement (Audited)

You will need to hire an actual certified auditor to come in and prepare these documents for you. They will need to have a look at your management accounts and your bookkeeping records for that financial year.

You need to ensure that you keep a very close eye on all the receipts and transactions because they will be used to balance out your financial statements. An error there will cause your numbers to be unbalanced and may subject you to an inquiry by the government.

Your failure to comply with this requirement is an offence that is punishable with a fine not exceeding RM 5000 or an imprisonment for a term not exceeding one year or both.

These offences are really serious and we want to make sure that you never get caught in a situation like that ever. SSM has released a new tool called MBRS – which helps companies submit their annual reports online. MBRS will be mandatory for all companies to use when it comes to submitting these documents in the next year.